|

"Hey, Wealthy Readers, Step Right Up"

What could be a more infuriating statistic than this: Last year, for the first time on record, the 400 wealthiest households paid taxes at a lower rate than any other group of Americans. Grrrr! We have more than 100,000 kids who are homeless each night, suicides are at a post-World War II high — and Trump tax cuts have allowed billionaires to pay a new low in tax rates.

|

That’s a statistic I use in today’s column to plunge into an argument that there’s a rot in our system, resulting from the way immense wealth translates into great political power, which then multiplies both the wealth and the power — while exacerbating the suffering of those at the bottom. It’s legal corruption.

|

Some people warn against “soaking the rich” and “class warfare.” But as Warren Buffett has observed: “There’s class warfare, all right. But it’s my class, the rich class, that’s making war, and we’re winning.” Americans are understandably focused on the impeachment process, but let’s recognize that these are problems that predated President Trump and will outlast him. One way of tackling these broader problems is the tax code, and my column argues that we’d be better off with a higher marginal tax rate on the very wealthy and also a small wealth tax of the kind that Senator Elizabeth Warren proposes — partly to finance high-quality preschool and other investments in human capital and American kids.

|

“Soak the rich” sounds a bit harsh, and etymologically it derives from “sock it to” someone. I’m not in favor of socking anyone. But it’s ridiculous that people like Jeff Bezos pay a lower tax rate than a struggling family with several kids to feed. So should we soak the rich to help disadvantaged kids and make America a fairer and more equitable country? You bet! Here’s my take.

|

My column draws partly on a book coming out next month: By M.I.T.’s Abhijit Banerjee and Esther Duflo, the incisive and illuminating “Good Economics for Hard Times” expertly guides the reader through issues like trade, automation and how best to help the needy. My copy is full of underlines and scribbled notes.

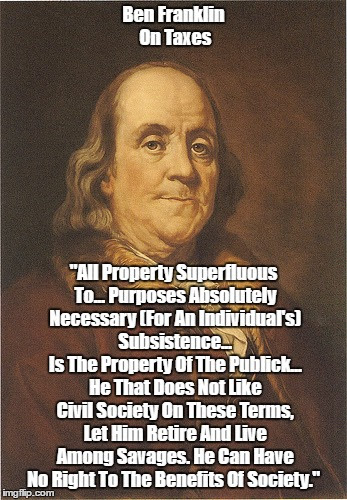

Ben Franklin On "No New Taxes"

1910 Income Tax Promised To Never Shift Burden From Richest 1 - 4%

|

No comments:

Post a Comment