“The most vocal proponents of the view that ordinary workers — not wealthy shareholders — suffer from high corporate taxes are … wealthy shareholders,” Emmanuel Saez and Gabriel Zucman write in their forthcoming book on the American tax system, “The Triumph of Injustice.”

|

They’re right about that. For decades, wealthy people, free-market economists and many politicians have argued that cutting taxes is good for the economy. Experience has shown otherwise.

|

Sometimes, the economy has boomed after tax cuts. More often, though, it’s done poorly after a tax cut (the early 2000s) or boomed after a tax increase (the 1990s). On the whole, there is no reason to believe that tax cuts are a smart strategy for accelerating economic growth.

|

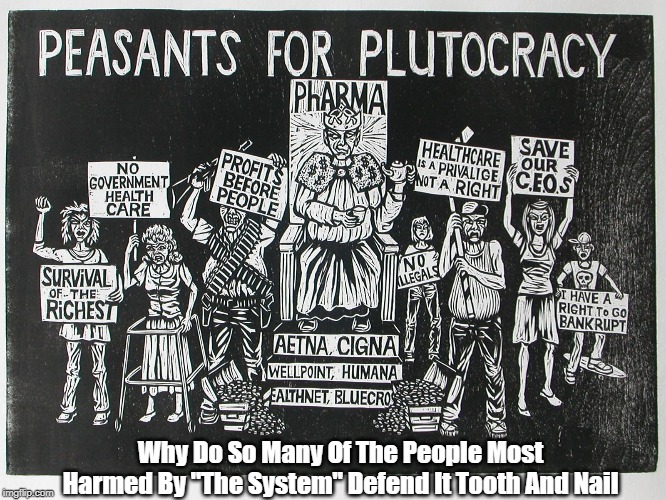

If anything, the evidence suggests that low taxes on the affluent create extreme inequality, which ends up hurting the economy. That’s what happened in both the 1920s and in recent decades. Since the 1980s, every tax that disproportionately affects the wealthy has declined sharply: top-end income taxes, investment taxes, the estate tax and the corporate tax (which shareholders effectively pay). And since the 1980s, economic growth has usually been disappointing, while middle-class income growth has been even more disappointing.

|

For the sake of economic growth, it’s time to raise taxes on the wealthy. My column today goes into more detail on the new book by Saez and Zucman. The headline fact from the book — and the subject of a chart that accompanies my column — is pretty shocking: Last year, for the first time on record, the 400 wealthiest American households paid a lower total tax rate than any other income group.

|

Trumplandia |

I enjoyed Monica Potts’s essay in the Sunday Review section, about the depth of support for President Trump in rural Arkansas. But I disagreed somewhat with the conclusion: that using government to combat inequality is a bad strategy for Democrats trying to win over these voters.

|

To be sure, most rural white voters are now loyal Republicans. The question for Democrats is how they can lose less badly. And polling suggests that emphasizing economic populism — including higher taxes on the rich and government programs for the middle class — is an effective approach. It’s also not clear to me what the alternative is. Democrats certainly won’t win over these voters by focusing on religious or cultural issues.

|

But I encourage you to read Potts’s piece, if you haven’t yet. My longer take on the politics of populism, from December, is here.

Evangelicals' Satanic Surrender To Trump: Bend Over, Clasp Ankles, Apply K-Y

|

No comments:

Post a Comment