Donald Trump Proposed The Biggest Tax Hike Ever - Enough To Make Bernie Sanders Blush

Alan: A notable characteristic of the conservative psyche is its strident insistence on immutable absolutes -- "NO NEW TAXES" for example. Then when their "unbending" principles crash and burn, what was formerly verboten is not only permissible but advisable. And then obligatory. Contemporary "conservatives" are not faithful to their vaunted ideals as much as they preach them to attempt conversion of their own faithless selves.

"Faith, Hope, Charity And Divine Desperation"

http://paxonbothhouses.

http://paxonbothhouses.

Grover Norquist's "No New Taxes Pledge"

Excerpt: "The pledge has been signed by all but 16 of the incoming Republican members of the House of Representatives — and all but 12 of Republicans currently in Congress."

Now, less than three years later, Norquist's pledge means nothing to no one.

Just debris in history's dustbin.

"Are Republicans Insane?" Best Pax Posts

http://paxonbothhouses.

http://paxonbothhouses.

Conservative Psychopathology: A Clinician's Guide

http://paxonbothhouses.

http://paxonbothhouses.

Compendium Of Best Pax Posts On "Too Pure Principles" And The Collapse Of Conservatism

Raising taxes on the wealthy?

Calling out income inequality?

Meet the new GOP.

We're living in a time in which Americans feel like the economy is rigged against them. And it's not just Elizabeth Warren whose saying that (or at least suggesting it) these days.

It's even many GOP contenders for president.

Republicans are striking an increasingly populist tone these days. On the presidential campaign trail, everyone from New Jersey Gov. Chris Christie to former Arkansas governor Mike Huckabee are decrying "reckless" big banks and the 1 percent "investor class." And then there's Donald Trump, who this week suggested he would raise taxes -- a third rail in the GOP if there ever was one -- on people who are wealthy like him, as well as hedge-fund managers.

It's not too hard to see why.

Two-thirds of Americans (68 percent) believe the economic system favors the wealthy rather than being fair, according to a July Washington Post/ABC News poll. About half of Republicans agreed with that statement.

And a full 83 percent of Americans said the wealth gap is a problem -- including 51 percent who call it a "major problem," according to a a Washington Post-ABC News poll conducted in January.

Here's a look at what the GOP contenders are saying:

Chris Christie: Hitting Obama on income inequality

Christie, in an interview with CNBC on Thursday, expanded on his criticism of the president for helping the rich.

"The guy who claims to care about income inequality has made income inequality worse than it's ever been in the country's history, 'cause he has played to the investor class and to make rich people richer," Christie said. "Here's the problem: Middle-class wages are stagnant for 15 years, and in fact they're behind the rate of inflation."

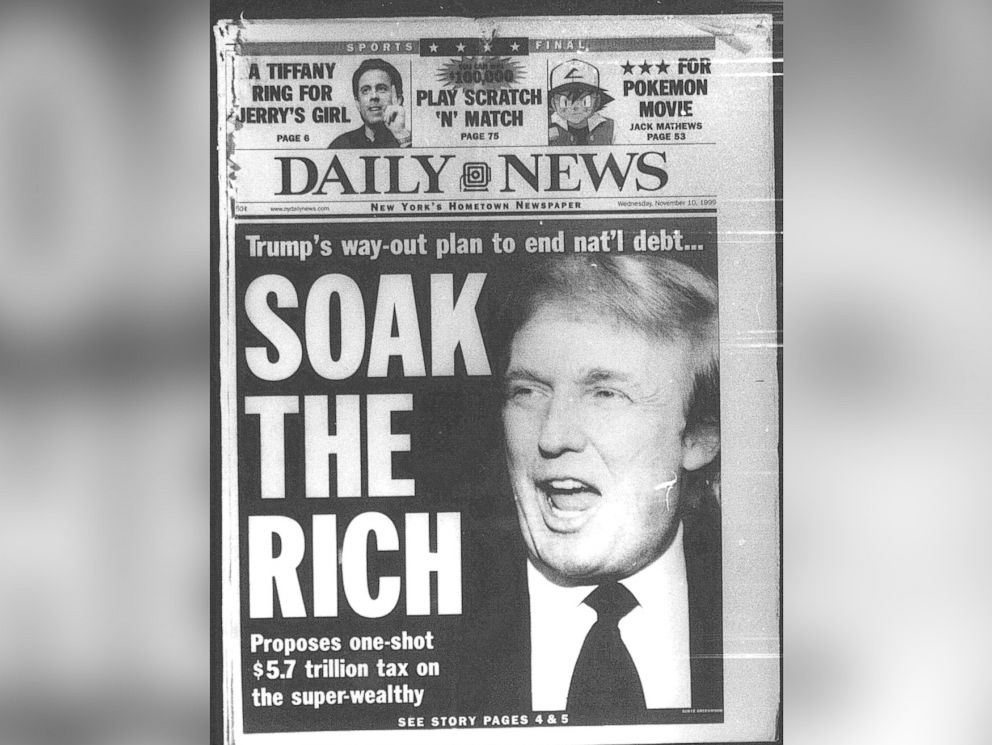

Donald Trump: Tax the wealthy

Trump is the closest thing conservatives have to a populist candidate. And yes, he stands out among the Republican field for his alternative views on a lot of issues. But Trump is the current GOP front-runner in part because he says things like this:

"I would take carried interest out, and I would let people making hundreds of millions of dollars-a-year pay some tax, because right now they are paying very little tax and I think it's outrageous," Trump told Bloomberg's "With All Due Respect" on Wednesday. "I want to lower taxes for the middle class."

He continued:

"You've seen my statements, I do very well, I don't mind paying some taxes. The middle class is getting clobbered in this country. You know the middle class built this country, not the hedge fund guys, but I know people in hedge funds that pay almost nothing and it's ridiculous, okay?

Jeb Bush: The banks are too big

Like most Republicans, the former Florida governor believes the 2010 Wall Street reform law, known as Dodd-Frank, hasn't helped stem corruption on Wall Street since the 2008 financial crash. While Republicans think regulations should be rolled back and Democrats think regulations should be stepped up, both sides agree that extra-large banks have no place in America's economy anymore.

"We have more banks with more concentrated assets in the United States, and the systematic risk is perhaps greater now than it was when the law was signed," he said in Berlin days before officially announcing his presidential campaign.

Bush added that regulation is needed for "bad banks."

John Kasich: Americans' anxieties are real

In an interview with Fox Business's Maria Bartiromo, the Ohio governor said Americans have every reason to be worried about stagnant salaries and losing their jobs.

Kasich, who once worked as an investment banker for Lehman Brothers, went onto say that he thinks big banks should be regulated via Dodd-Frank but that some regulations hurting medium and small banks should be lifted.

"We are regulating the big banks and, frankly, we need to," he said. "What they really need to do is to have -- is to have reserve requirements against the risk taking so that if, in fact, they go down, the American taxpayers don't pick it up."

Mike Huckabee: Reckless big banks are 'on their own'

The former Arkansas governor also has un-kind words for large Wall Street banks.

In a May economic policy speech in South Carolina, Bloomberg reported that Huckabee stopped just short of saying those banks should be dismantled.

"It ought to be a market decision,” he told reporters after the speech. “But if the boards of those banks know they are not going to be bailed out, and if they continue reckless policies that put them in a position of vulnerability, they are on their own.”

Rand Paul: Stop monetary policy that favors the wealthy

(AP Photo/Timothy D. Easley)

The libertarian-leaning Kentucky senator is also hesitant to break up big banks, but Paul has said he'd like to limit how big they can get.

Paul told reporters in 2013 that he'd support resurrecting a wall between commercial and investment banking to avoid irresponsible lending. Such a law would basically reinstitute the 1993 Glass-Steagal Act, which President Bill Clinton repealed.

Paul, who campaigns on giving Congress greater oversight of the independent Federal Reserve, also recently slammed the Fed for favoring the wealthy.

"Americans then and now were lectured that the trillions in loans and asset purchases were all for their own good and eventual benefit, to resuscitate the credit markets and bolster home values. Yet the truth remains — it is Wall Street that benefits from the Fed at the expense of Main Street," he wrote in an Aug. 20 column on Reason.com, co-authored with investor Mark Spitznagel.

They continued: "It's unfortunately in keeping with Fed policies that disproportionately favor wealth — like low interest rates, a policy benefiting those that have the most assets and first access to borrowing, not for people who have little or no capital."

Marco Rubio: Stop corporate welfare

The Florida senator is among a wave of conservative Republicans who despise an entirely different bank: The Export-Import Bank. The quasi-government bank, which provides loans to help U.S. companies do risky-ish business abroad, is shut down at least temporarily after Congress failed to reauthorize it in June.

Rubio's and others' arguments for keeping it shut rings of populism. The bank funds big corporations, like Boeing and Caterpillar, at the expense of the little guy, they say.

"The bank is a conduit for taxpayer-subsidized corporate welfare that allows federal government bureaucrats to pick winners and losers in the marketplace," Rubio said in a statement in July filing an amendment to kill the bank.

Ted Cruz: Stop corporate welfare

Perhaps no Republican presidential candidate is railing against the Ex-Im Bank as much as Texas Sen. Ted Cruz, who recently called Senate Majority Leader Mitch McConnell (R-Ky.) "a liar" on the Senate floor in a spat over the bank's reauthorization. (The Senate eventually voted to revive the bank, but the House of Representatives has yet to take it up.)

In a USA Today op-ed on July 30 -- days after the Senate approved the bank -- Cruz called it a "corrupt, crony-capitalist fiasco.

"The debate over keeping it open will be a telling one," Cruz said. "Those siding with foreign corporations, lobbyists and crony politicians will be on one side. Those fighting for the values and interests of American workers will be on the other."

Amber Phillips writes about politics for The Fix. She was previously the one-woman D.C. bureau for the Las Vegas Sun and has reported from Boston and Taiwan.

No comments:

Post a Comment