What Is The Relationship Between The Federal Funds, Prime And LIBOR Rates?

http://www.investopedia.com/articles/investing/060214/what-relationship-between-federal-funds-prime-and-libor-rates.asp

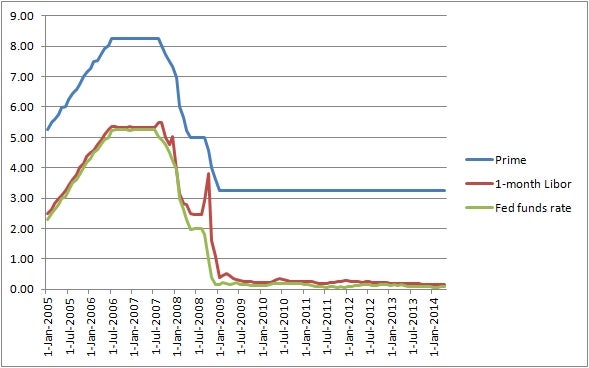

Alan: The 3% "spread" between the Fed funds rate (in green) and the prime rate (in blue) represents the profit margin "turned" by commercial banks when they loan out at 3% the same money the Fed "gives them" them for 0%.

Non-prime loans yield even higher profit margins - often two to three times as much... and sometimes more.

Non-prime loans yield even higher profit margins - often two to three times as much... and sometimes more.

This week, the Federal Reserve System will raise interest rates above 0% for the first time in nine years.

Here is how "The System" works.

After the banks receive their distribution of "free money," they "turn around" and charge citizens about 3% to borrow it.

It is an unbelievably simple system but devilishly difficult to believe because, intuitively, it seems impossible that this ongoing "gift" -- this ceaseless "transfer payment" from government to commercial banks -- is a reality.

Believe it!

For the last nine years the commercial banking system has borrowed money from the Federal Government at NO cost.

0%

However that same money will cost you 3% - assuming your financial house is in order and the bank considers you an exceptionally low "credit risk." (Please keep in mind that during the run-up to the 2007 economic landslide which resulted in The Great Recession, the federal government NEVER inquired into the credit worthiness of the same commercial banks which are currently on the receiving end of "a free money dole.")

Recently, my brother Gerald -- 2nd in command at the 5th largest U.S. accounting firm outside New York City -- confirmed my longstanding supposition that The Fed's commercial bank lending practice is in fact a gift of 3% to every commercial bank that borrows at The Fed's so-called "discount window."

But even when the Fed's interest rate is higher than 0%, the spread (i.e., the difference between the green line and blue line in the graph above) always stays around 3%.

It is as if I gave you a million dollars at 0% interest; told you to pay it back at some convenient time in the future; and "While you're going about business Mr. Banker, pocket the $30,000.00 a year which your clients pay you for borrowing "free money" from the ever attentive Fed.

Essentially, this Fed-to-commercial-bank lending is "money for nothing."

The scam is so brazen that few people can bring themselves to believe that their trusted government would work such ceaseless sleight-of-hand (sleight-of-wallet?), and furthermore would do so -- in full view -- each and every business day.

Which also proves that if you want to hide something really monstrous, hide it in plain sight!

Which also proves that if you want to hide something really monstrous, hide it in plain sight!

Here is what The Fed is likely to do this week by way of raising interest rates...

Tuesday, Dec. 16: Interest rate liftoffThe Federal Reserve begins a two-day monetary policy meeting on Tuesday that is widely expected to produce the first uptick in the central bank's federal funds rate in nine years. That rate has been effectively zero since late 2008.

DATA SOURCE: FEDERAL RESERVE ECONOMIC DATA.

Yet in a recent speech, Fed chairwoman Janet Yellen noted that officials have seen "continued improvement" in many of the key metrics, like employment growth and economic activity, that they've been looking for to support a return to non-zero interest rates.

Since that speech, the economic picture has only brightened. The monthly jobs report last week showed that the economy produced over 200,000 new jobs as the unemployment rate held steady at a seven-year low of 5%. While investors can expect the Fed to begin raising rates this week, they shouldn't count on a quick lift off. Central bank officials' latest projections put interest rates below 3% as far out as 2017.

No comments:

Post a Comment