The following story, "26

Major Corporations Paid No Corporate Income Tax For The Last Four Years,

Despite Making Billions In Profits, has been nominated

"Most Likely Not To Be Covered By Fox News"

Romney's most recent tax returns reveal a

typical wealthy American -- hugely favored by the I.R.S. -- struggling to get

his tax rate above 13%.

Here is Warren Buffet's view of tax

moochers like Romney. http://www.youtube.com/watch?v=44g-i1n4obA

Other Buffett bits:

‘Class Warfare’: http://www.nytimes.com/2006/11/26/business/yourmoney/26every.html

‘Hedge Funds as "weapons of mass

destruction"’: http://news.bbc.co.uk/2/hi/2817995.stm

‘Buffett slams Private Equity Group’ - http://www.forbes.com/sites/robertlenzner/2012/01/14/why-warren-buffett-loathes-the-private-equity-crowd/

/// http://blogs.wsj.com/deals/2009/03/02/warren-buffett-hell-hath-no-fury-like-an-oracle-scorned/)

Rockefeller Republican that he is, Obama

has made meaningful tax overhaul central to his next.

Meaningful tax reform will be opposed by

The Party of Rich White Guy Job Creators

whose raison d'etre is robbing the poor to give to the rich.

What, prithee, have The Job Creators actually created since Bush's

unprecedented tax cuts of 2001 and 2003?

Hint...

Economic havoc.

http://paxonbothhouses.blogspot.com/2012/05/republican-rule-and-economic.html

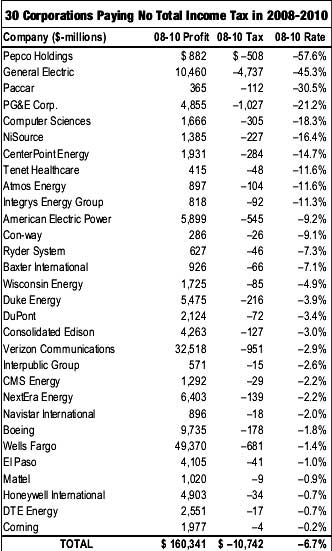

Last year, Citizens for Tax Justice found that 30 major corporations had made billions of dollars in profits whilepaying no federal income tax between 2008 and 2010. Today, CTJ updated that report to reflect the 2011 tax bill of those 30 companies, and 26 of them have still managed to pay absolutely nothing over that four year period:

Last year, Citizens for Tax Justice found that 30 major corporations had made billions of dollars in profits whilepaying no federal income tax between 2008 and 2010. Today, CTJ updated that report to reflect the 2011 tax bill of those 30 companies, and 26 of them have still managed to pay absolutely nothing over that four year period:

***

26 Major Corporations Paid No Corporate Income Tax For The Last Four Years, Despite Making Billions In Profits

Last year, Citizens for Tax Justice found that 30 major corporations had made billions of dollars in profits whilepaying no federal income tax between 2008 and 2010. Today, CTJ updated that report to reflect the 2011 tax bill of those 30 companies, and 26 of them have still managed to pay absolutely nothing over that four year period:

Last year, Citizens for Tax Justice found that 30 major corporations had made billions of dollars in profits whilepaying no federal income tax between 2008 and 2010. Today, CTJ updated that report to reflect the 2011 tax bill of those 30 companies, and 26 of them have still managed to pay absolutely nothing over that four year period:– 26 of the 30 companies continued to enjoy negative federal income tax rates. That means they still made more money after tax than before tax over the four years!– Of the remaining four companies, three paid four year effective tax rates of less than 4 percent

(specifically, 0.2%, 2.0% and 3.8%). One company paid a 2008-11 tax rate of 10.9 percent.– In total, 2008-11 federal income taxes for the 30 companies remained negative, despite $205 billion in pretax U.S. profits. Overall, they enjoyed an average effective federal income tax rate of –3.1 percent over the four years.

Amongst the 30 are corporate titans such as General Electric, Boeing, Verizon, and Mattel. The only four companies that slipped into positive tax territory were DTE Energy, Honeywell, Wells Fargo, and DuPont, with DuPont the only one that paid more than 4 percent over the four years.

Corporate taxes in the U.S., contrary to the constant protestations of conservatives, are at a 40 year low, with many of the most profitable companies paying nothing at all. CTJ noted that “had these 30 companies paid the full 35 percent corporate tax rate over the 2008-11 period, they would have paid $78.3 billion more in federal income taxes.” And this is not a problem that only afflicts the U.S., as the UK found out last week that online retailer Amazon made billions in sales in 2011, while paying nothing in corporate taxes.

No comments:

Post a Comment