By Jonathan Weisman

THE NEW YORK TIMES

July 23, 2012

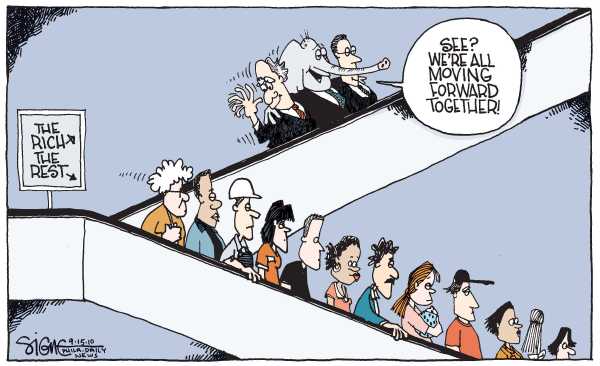

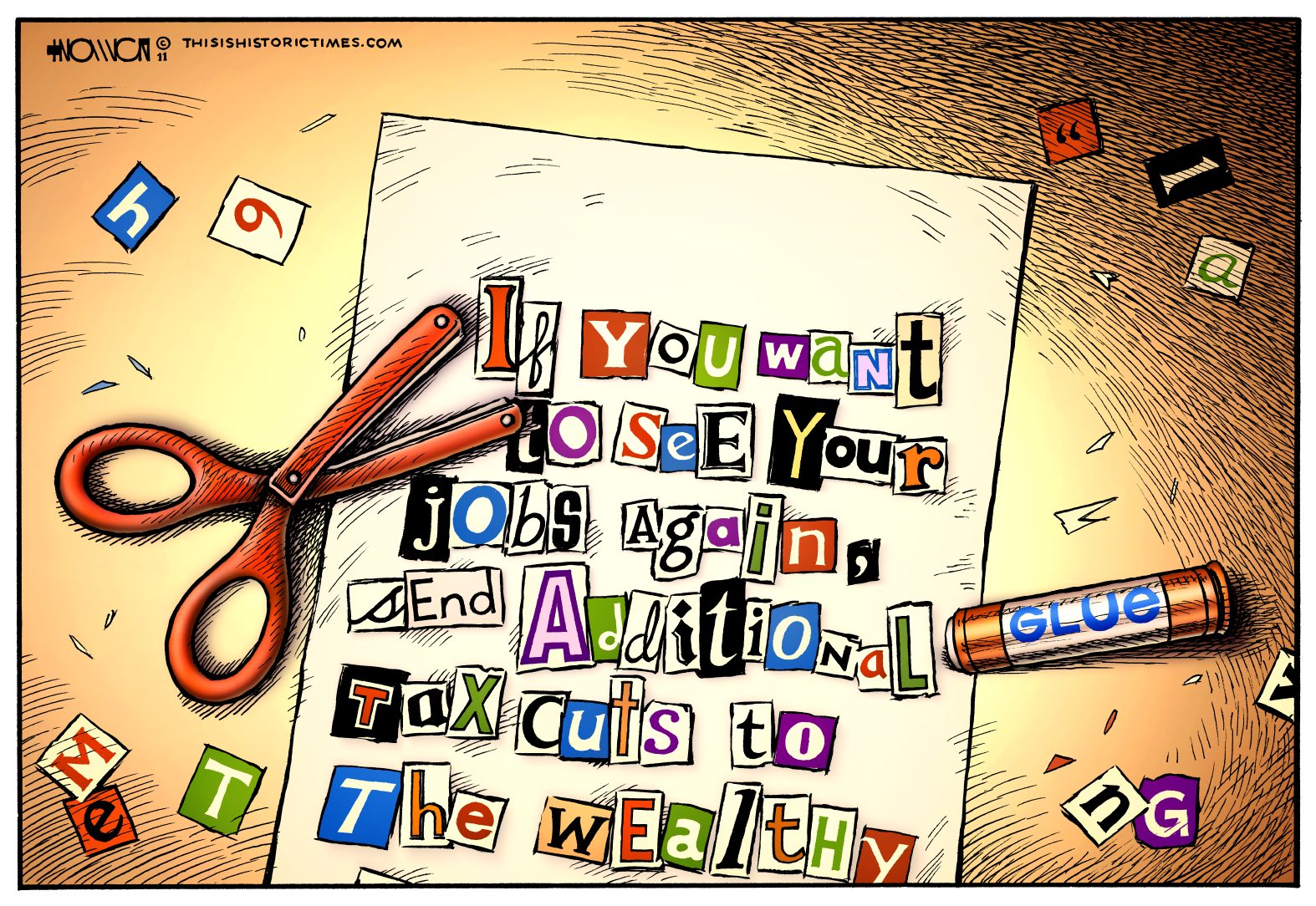

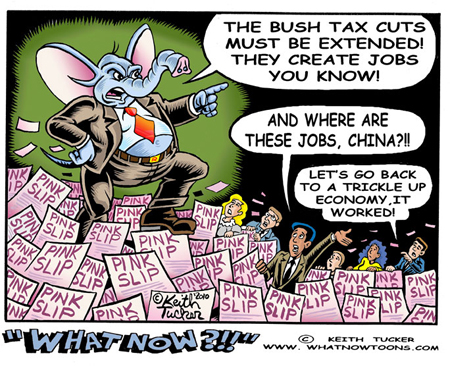

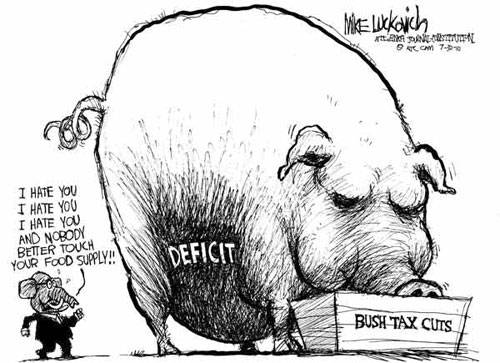

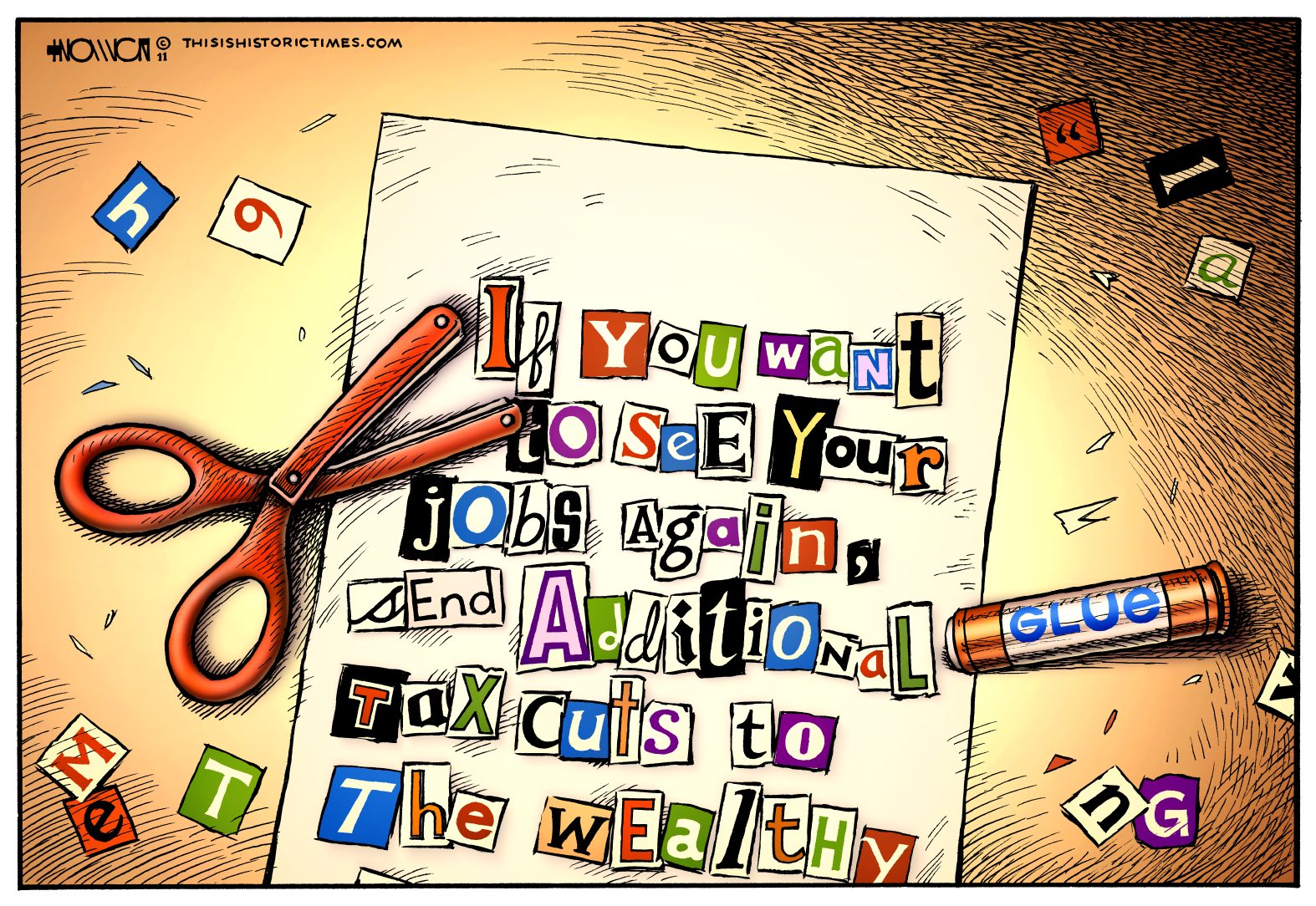

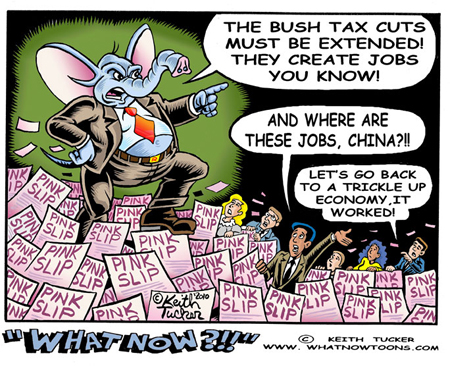

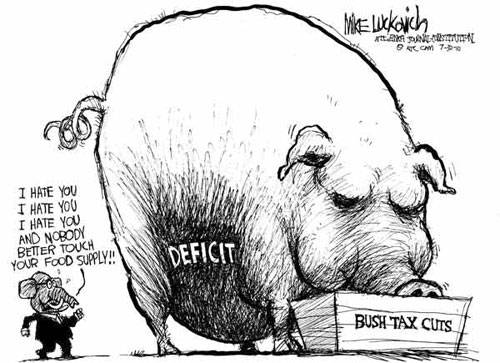

WASHINGTON — Senate Republicans will press this week to extend tax cuts for affluent families set to expire Jan. 1, but the same Republican tax plan would allow a series of tax cuts for the working poor and the middle class to end next year.

Republicans say the tax breaks for lower-income families — passed with little notice in the extensive 2009 economic stimulus law — were always supposed to be temporary. But President Barack Obama made them a priority in 2009 and demanded their extension in 2010 as a price for extending the Bush-era tax cuts for two years, and both the White House and Senate Democrats are determined to extend them again.

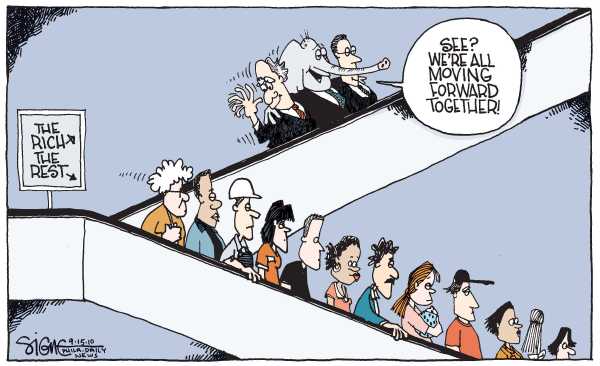

That sets up a potentially tricky issue for Republicans. They have said they don't want taxes to go up on anyone while the economy struggles to gain altitude, but under their plan, written by Sen. Orrin Hatch of Utah, the senior Republican on the Finance Committee, about 13 million families would see their tax refunds reduced, and some would see their taxes increase.

In all, the Republican plan would extend tax cuts for 2.7 million affluent families while allowing tax breaks to expire for the 13 million on the bottom of the income spectrum, tax analysts say.

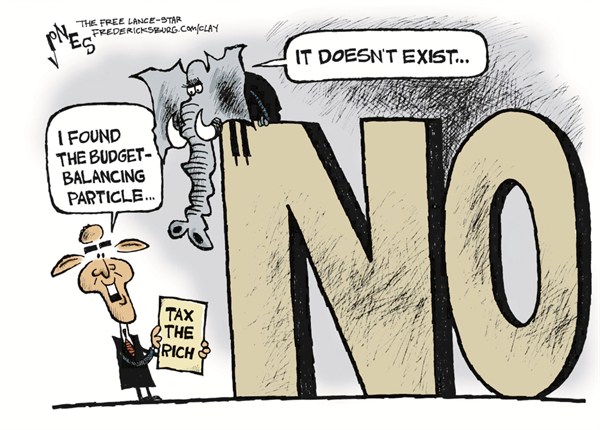

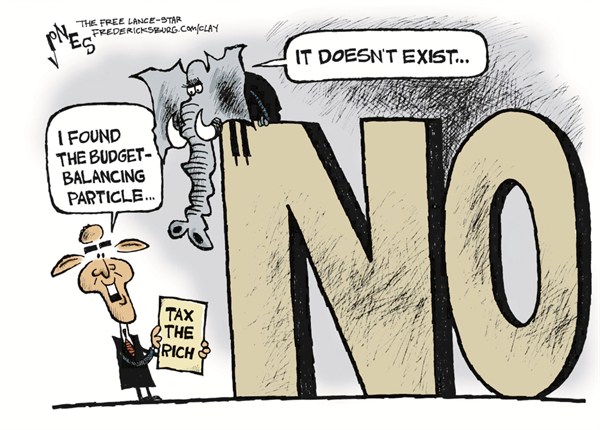

"Sen. Hatch's amendment would extend tax breaks for the top 2 percent of Americans," Sen. Harry Reid of Nevada, who leads the Senate's Democratic majority, said this month. "But it fails to extend a number of tax cuts that help middle-class families get by in a tough economy."

The tax showdown is set for Wednesday, when the Senate will vote on whether to take up Democratic legislation to extend Bush-era middle-class tax cuts through 2013. The motion will need 60 votes to pass, and only if it gets those votes will Republicans be given a chance to vote on their alternative tax plan. The House will vote next week on a similar Republican plan.

Republican tax aides say the vast majority of the benefits Democrats are seeking to preserve aren't tax cuts but checks written by the Internal Revenue Service for the working poor. Given increases in such government aid as food stamps and unemployment benefits, letting some assistance lapse makes sense, they say.

No comments:

Post a Comment