Cartoon from a 1909 issue of Puck magazine. A caption read, "Dedicated to the states where child labor is still permitted."

Alan: Not long ago, usury was considered such grievous sin that "banking" (and the moral filth on which it hinged) were left to European Jews.

"Back then," righteous Christians shunned usury like a rabid dog loose in the house. http://paxonbothhouses.

Nowadays, there is no nun, priest nor Christian scold who does not carry multiple credit cards, all of them charging usurious rates of interest.

We Have Multiplied And Filled The Earth: What Now For Natural Law?

Personally, I would like to see more focus on usury but ever since triumphant Capitalism vanquished traditional moral theology -- simultaneously elevating every deadly sin to "Glamor Status" -- it is impossible to suggest any "banking regulation" without "good Christians," up in arms, shouting you down.

Conservative Christianity knows full well which side its bread is buttered on.

And it is Mammon who does the buttering.

Chesterton: Plenty Of Books Denounce Lust But What Of Those That Encourage Greed

Shallowness And "The Thinking Housewife"

Not long ago, the pursuit of commercial self-

interest was largely reviled.

How did we come to accept it?

interest was largely reviled.

How did we come to accept it?

Among MBA students, few words provoke greater consternation than “greed.” Wonder aloud in a classroom whether some practice might fairly be described as greedy, and students don’t know whether to stick up for the Invisible Hand or seek absolution. Most, by turns, do a little of both.

Such reactions shouldn’t be surprising. Greed has always been the hobgoblin of capitalism, the mischief it makes a canker on the faith of capitalists. These students' troubled consciences are not the result of doubts about the efficacy of free markets, but of the centuries of moral reform that was required to make those markets as free as they are.

We sometimes forget that the pursuit of commercial self-interest was largely reviled until just a few centuries ago.

“A man who is a merchant can seldom if ever please God,” St. Jerome said, expressing the prevailing belief in Christendom about the relative worthiness of a life devoted to trade. The choice to enter business didn’t necessarily deprive one of salvation, but it certainly hazarded his soul. “If thou wilt needs damn thyself, do it a more delicate way than drowning,” Iago tells a lovesick Rodrigo. “Make all the money thou canst.”

“A man who is a merchant can seldom if ever please God,” St. Jerome said, expressing the prevailing belief in Christendom about the relative worthiness of a life devoted to trade. The choice to enter business didn’t necessarily deprive one of salvation, but it certainly hazarded his soul. “If thou wilt needs damn thyself, do it a more delicate way than drowning,” Iago tells a lovesick Rodrigo. “Make all the money thou canst.”

The problem of money-making was not only that it favored earthly delights over divine obligations. It also inflamed the tendency to prefer our own needs over those of the people around us and, more worrisome still, to recklessly trade their best interests for our own base satisfaction. St. Thomas Aquinas, who ranked greed among the seven deadly sins, warned that trade which aimed at no other purpose than expanding one’s wealth was “justly reprehensible” for “it serves the desire for profit which knows no limit.”

"Pope Francis Links"

It was not until the mischievous moralist Bernard Mandeville that someone attempted to gloss greed as anything other than a shameful motive. A name now largely lost to history, Mandeville became a foil for 18th-century philosophy when, in 1705, he first proposed his infamous equation: Private vices yield public benefits. It came as part of The Fable of the Bees, an allegorical poem that described a thriving beehive where dark intentions keep the wheels of commerce turning. The outrage Mandeville stoked had less to do with this causal explanation than with the assertion that only by such means could a nation grow wealthy and strong. As he contended (with characteristic bluntness) in the conclusion to the Fable:

T’ enjoy the World’s Conveniences,

Be fam’d in War, yet live in Ease,

Without great Vices, is a vain

EUTOPIA seated in the Brain.

Be fam’d in War, yet live in Ease,

Without great Vices, is a vain

EUTOPIA seated in the Brain.

Philosophers lined up to take their shots at Mandeville, whose moral paradox seemed so appalling precisely because it could not be so easily dismissed. The most notable among them was Adam Smith, the founding father of modern economics, who struggled to distinguish the mainspring of his system from the one Mandeville proposed.

Consider how Smith describes the selfish landowner, of whom he says the “proverb, that the eye is larger than the belly, never was more fully verified.” Looking out over his fields, in his imagination, he “consumes himself the whole harvest.” The belly, however, is not so obliging. The greedy landlord may engorge himself without making a dent in his crop, and he is “obliged to distribute” the rest in payment to all those who help supply his “economy of greatness.”

This is Smith’s Invisible Hand at work. It is counter-intuitive force for good that, on first glance, seems not especially different from Mandeville’s contention that private vices yield public benefits. Smith was sensitive to this fact—Bernard Mandeville did not exactly make for good company—and he struggled to create distance between them.

Here's that finger now...

He did this in two ways. First, Smith emphasized the moral distinction between primary aims and secondary effects. The Fable of the Bees never explicitly claimed that vice was good in itself, merely that it was advantageous—a subtle distinction that created confusion for Mandeville’s readers which the author, a cynic through and through, made little effort to dispel.

Smith, by contrast, made abundantly clear that, as a matter of moral assessment, one should distinguish between the intentions of an actor and the broader effects of his actions. Recall the greedy landlord. Yes, the primary aims of his daily labors—vanity, sway, self-indulgence—are far from admirable. But in spite of this fact, his efforts still have the effect of distributing widely “the necessaries of life” such that, “without intending it, without knowing it,” he, and others like him, “advance the interest of society.” This is another way of saying, for Smith, the moral logic of free markets was a law of unintended consequences. The Invisible Hand gives what a greedy landlord takes.

The second move Smith made was to effectively redefine “Greed.” Mandeville—and for that matter, the Church Fathers before him—spoke in such a way that any self-interested pursuit seemed morally suspect. Smith, for his part, refused to go along. He acknowledged that pursuing our interests often entails getting what we want from other people, but he maintained that not all of these pursuits, morally speaking, were equal. We get what we want in a complex commercial society—indeed, we get to have a complex commercial society—not because we seize things outright, but because we pursue them in a way that acknowledges legal and cultural constraints. That is how we distinguish the merchant from the mugger. Both pursue their own interests, but only one does so in a manner that confers legitimacy on the gains.

Greed, as such, became an acquisitive exercise that fell on the wrong side of this divide. Some of these activities, like the mugger’s, were fairly prohibited, but those of, say, the mean-spirited merchant were checked by censure and disgrace. These forces did not eradicate selfishness, but by the moral distinction they maintained, they helped establish a new ideal of the upstanding businessman.

That ideal was famously embodied by Smith’s friend, Benjamin Franklin. In his Autobiography, Franklin presented himself as the epitome of a new American Dream, a man who emerged from “Poverty & Obscurity” to attain “a State of Affluence & some Degree of Reputation in the World.” Franklin found nothing to be ashamed of in riches and repute, provided they were turned toward some broader purpose. His success allowed him to retire from the printing business at 42 so that he might spend the balance of his life on initiatives—civic, scientific, philanthropic—that all enhanced the common good.

Alan: Here's how Franklin would fulfill his vision of "broader purpose" through taxation.

Benjamin Franklin to Robert Morris -

"The Remissness of our People in Paying Taxes is highly blameable; the Unwillingness to pay them is still more so. I see, in some Resolutions of Town Meetings, a Remonstrance against giving Congress a Power to take, as they call it, the People's Money out of their Pockets, tho' only to pay the Interest and Principal of Debts duly contracted. They seem to mistake the Point. Money, justly due from the People, is their Creditors' Money, and no longer the Money of the People, who, if they withold it, should be compell'd to pay by some Law.

"Politics and Economics: The 101 Courses You Wish You Had"

The example of Franklin, and those like him, gave reason for optimism to those who understood the mixed blessing of free-markets. “Whenever we get a glimpse of the economic man, he is not selfish,” the great English economist Alfred Marshall wrote toward the end of the 19th century. “On the contrary, he is generally hard at work saving capital chiefly for the benefit of others.” By “others,” Marshall principally meant the members of one’s family, but he was also making a larger point about how our “self-interest” can expand and evolve when we have achieved financial security. The “love of money,” he declared, encompasses “an infinite variety of motives,” which “include many of the highest, the most refined, and the most unselfish elements of our nature.”

"You cannot serve both God and money."

"Does Money Make You Mean?"

Then again, they also include lesser elements. Andrew Carnegie might have proclaimed that it was the responsibility of a rich man to act as “agent and trustee for his poorer brethren,” but the steel magnate’s beneficence was backstopped by cheap labor, dangerous working conditions, and swift action to break strikes. Besides, the active redistribution of wealth was something of a side-story (and a subversive one at that) to the moral logic of free markets. The Invisible Hand worked not by appealing to the altruism of exceptionally rich men, but by turning an antisocial instinct like greed into an unwitting civil servant.

"A philanthropist is someone who gives away what he should give back."

Still, by the early 20th century, some believed his services might safely be dismissed. Reflecting on the extraordinary rate of development in Europe and the United States, John Maynard Keynes suggested that “the economic problem” (which he classed as the “struggle for subsistence”) might actually be “solved” by 2030. Then, Keynes said, we might “dare” to assess the “love of money” at its “true value,” which, for those who couldn’t wait, he described as “a somewhat disgusting morbidity, one of those semi-criminal, semi-pathological propensities which one hands over with a shudder to the specialists in mental disease.” In other words, at last, we could afford to shift our attention from the advantages of greed and to disadvantages of greedy people.

"The merely rich are not rich enough to rule the modern market. The things that change modern history, the big national and international loans, the big educational and philanthropic foundations, the purchase of numberless newspapers, the big prices paid for peerages, the big expenses often incurred in elections - these are getting too big for everybody except the misers; the men with the largest of earthly fortunes and the smallest of earthly aims. There are two other odd and rather important things to be said about them. The first is this: that with this aristocracy we do not have the chance of a lucky variety in types which belongs to larger and looser aristocracies. The moderately rich include all kinds of people even good people. Even priests are sometimes saints; and even soldiers are sometimes heroes. Some doctors have really grown wealthy by curing their patients and not by flattering them; some brewers have been known to sell beer. But among the Very Rich you will never find a really generous man, even by accident. They may give their money away, but they will never give themselves away; they are egoistic, secretive, dry as old bones. To be smart enough to get all that money you must be dull enough to want it."

G. K. Chesterton

Keynes’s views were extreme, but only in expression. Substantively, everyone agreed with him that greed was still a vice and a rather vicious one at that. A. Lawrence Lowell, the President of Harvard University, called “a motive above personal profit” among businessmen a prerequisite for establishing Harvard Business School, while its first dean, Edwin Francis Gay, told a prospective faculty hire that the pedagogy of his institution did not include “teaching young men to be ‘moneymakers.’”

As a lingering distaste for the profit-motive combined with continued economic development, the assumption began to wane that self-interested pursuits were the organizing force of a modern economy. Keynes pointed to this when he extolled the “tendency of big enterprise to socialize itself,” a phenomenon by which enlightened middle-managers—guided by science, reason, and administrative esprit du corps—would at last supplant the animism of the Invisible Hand. If “the corporate system is to survive,” Adolf Berle and Gardiner Means wrote in the conclusion to their seminal study of the modern American corporation, “the ‘control’ of the great corporation should develop into a purely neutral technocracy, balancing a variety of claims by various groups in the community and assigning to each a portion of the income stream on the basis of public policy rather than private cupidity.”

Berle and Means wrote these lines in 1932. In hindsight, they don’t seem exactly prescient. As a matter of economic science, the revolt against managerial capitalism, and the reevaluation of greed, took shape after the Second World War, led by efforts of the Austrian economist Joseph Schumpeter and, later on, the architects of Agency Theory. Against Keynes, Schumpeter presented a new vision of capitalism as “Creative Destruction.” The “relevant problem” for economists, he said, was not how capitalism “administers existing structures” (the purview of the middle-manager) but “how it creates and destroys them,” an anarchic activity undertaken by Schumpeter’s hero, the entrepreneur.

As an icon for capitalism, the pugnacious individualism of the entrepreneur was entirely at odds with the vision of Berle and Means. According to Schumpeter, what drove an economy was headlong innovation, not careful administration. This was the hallmark of entrepreneurial activity, the courageous effort of an inspired mind, not the fruit of corporate collaboration.

An appeal to “private cupidity” was not the only way of eliciting such inspiration, but it was certainly the most obvious. It was also favored by the enthusiasts of Agency Theory, who began filling the ranks of business schools and economics departments in the ‘60s and ‘70s. They eschewed the common cause of managerial capitalism as an endorsement of soft socialism, an inducement to fuzzy thinking, and a recipe for corporate decay. Instead, they portrayed the company as a collection of self-serving individuals whose interests could be aligned with those of shareholders only by appeals to Keynes’s semi-pathological propensity: the love of money. Thus, the rise of stock options, performance pay, and other compensatory strategies that aimed to spark innovation in the executive suite. For the most part, the moral arguments called upon to support these recommendations took a familiar form. Greedy behavior could be tolerated, even encouraged, but only if it eliminated worse offenses: starvation, exposure, idiocy.

"Almost Always Money Is A Poor Motivator"

But choosing a lesser evil at the expense of a greater one is merely an exercise in good judgment. It does nothing to change the nature of what is chosen, and when a nation no longer fears, first and foremost, the pangs of abject misery, it may be said that greed has largely served its social purpose. An affluent people might fairly turn their attention to the ugly behavior greed encourages and to the social and political perils of extreme inequality. They may have good reason, in short, to restrain the Invisible Hand.

Accordingly, in recent decades, a new line of argument has opened in the moral defense of greed, a change that was augured and embodied above all others by Ayn Rand. Rand understood that, when someone defended greed by an appeal to the common good, he was also conceding that greed could be checked by it. As the moral foundation for free markets, such an argument was entirely unacceptable to Rand, who took aim at it in her 1965 essay What is Capitalism?

“Implicitly, uncritically, and by default, political economy accepted as its axioms the fundamental tenets of collectivism,” she declared in a sweeping indictment of the Invisible Hand tradition. “The moral justification of capitalism does not lie in the altruist claim that it represents the best way to achieve ‘the common good.’” That may be so, but it is “merely a secondary consequence.” Instead, capitalism is the only economic system in which “the exceptional men” are not “held down by the majority” and in which (as she said elsewhere) the “only good” that humans can do to one another and “the only statement of their proper relationship” are both acknowledged: “Hands off!”

"Ayn Rand: Atheist Cornerstone of Republican Economics"

Ayn Rand quotation: "I am against God."

A woman who titled a collection of essays The Virtue of Selfishness, Rand was given to brackish candor. Yet at a time when many people think that the common good is more often imperiled than empowered by unbridled greed, she provides an alternative defense of the acquisitive instinct by appealing to an ethics of gross achievement and a formulation of personal liberty that looks with suspicion and disdain on any talk of civic duty, moral obligation, or even prudential restraint. Her aim was simple: To relieve greed, once and for all, of any moral taint.

“I think greed is healthy,” an apparent acolyte told the graduating class at Berkeley’s business school in 1986. “You can be greedy and still feel good about yourself.” The speaker was Ivan Boesky, who shortly thereafter would be fined $100 million, and later go to prison, for insider trading. His address was adapted by Oliver Stone as the basis for Gordon Gekko’s “greed is good” speech in Wall Street. An exhortation to shareholders of a sagging company, it reads like a corporate raider’s war cry, with Gekko the grinning avatar of Agency Theory.

Such a blunt endorsement of greed today remains far beyond the mainstream. If we tolerate greed, it is because we accept the hard bargain of the Invisible Hand. We believe that greed can do good, not that it is good. That, we are unwilling to say.

But for the most part, I don’t think we say very much about greed, not comfortably at least. Perhaps that is the inevitable price of an economic system that relies on the vigor of self-interested pursuits, that it instills a kind of moral quietism in the face of avarice, for whether out of a desire to appear non-judgmental or for reasons of moral expediency, unless some action verges on the criminal, we hesitate to call it greed, much less evidence of someone greedy. We don’t deny the existence of such individuals, but like Bigfoot, they tend to be more rumored than seen.

Moral revolutions come about in different ways. If we reject some conduct but rarely admit an example, we enjoy the benefit of being high-minded without the burden of moral restraint. We also embolden that behavior, which proceeds with a presumptive blessing. As a matter of public discourse and polite conversation, “Greed” is unlikely to be “Good” anytime soon, but a vice need not become a virtue for the end result to look the same.

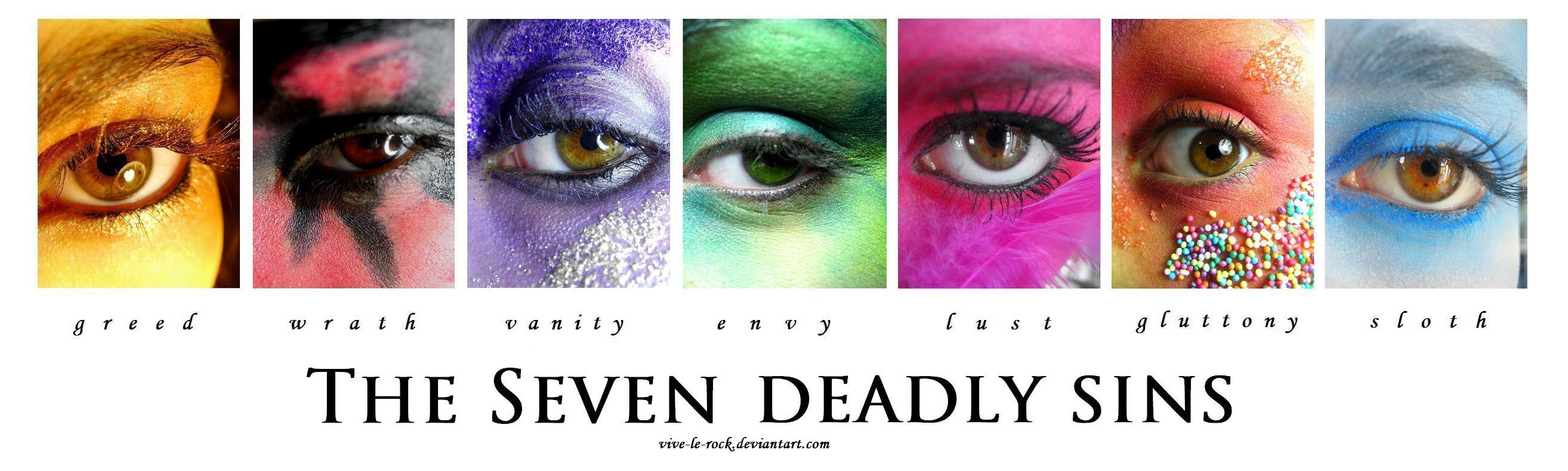

The Seven Deadly Sins

And Their Deliberate Nurturance By Unbridled Capitalism

The Hard Central Fact Of Contemporary Conservatism

The hard, central "fact" of contemporary "conservatism" is its insistence on a socio-economic threshold above which people deserve government assistance, and below which people deserve to die.

The sooner the better.

Unless conservatives are showing n'er-do-wells The Door of Doom, they just don't "feel right."

To allay this chthonic anxiety, they resort to Human Sacrifice, hoping that spilled blood will placate "the angry gods," including the one they've made of themselves. http://paxonbothhouses.blogspot.com/2013/09/harvard-study-45000-americans-die.html

Having poked their eyes out, they fail to see that self-generated wrath creates "the gods" who hold them thrall

Almost "to a man," contemporary "conservatives" have apotheosized themselves and now -- sitting on God's usurped throne -- are rabid to pass final judgment.

Self-proclaimed Christians, eager to thrust "the undeserving" through The Gates of Hell, are the very people most likely to cross its threshold.

Remarkably, none of them are tempted to believe this.

No comments:

Post a Comment