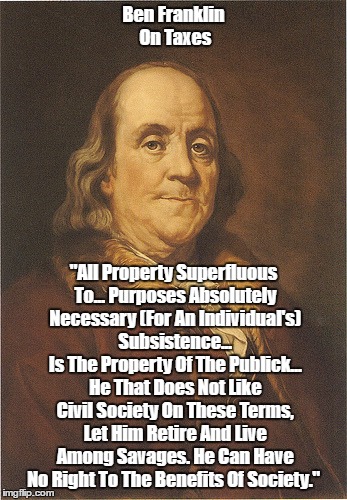

"Founding Fathers Profit-Sharing Remedy For Inequality.

Even Ronald Reagan Likes It!"

("The History Of Corporations In The United States. A Return To Roots?")

A Simple Fix for Our Massive Inequality Problem

Excerpt: "The wealth of the top 1 percent increased by an average of $4.9 million over the past decade, while the average holdings of the bottom 99 percent declined by about $4,500."

Everyone knows that we are again living in a Gilded Age.

Everyone knows that we are again living in a Gilded Age.

More controversial is the question of what should be done about it. We seem stuck in the same policy equilibrium we have been in for decades, with conservatives denying that there is a problem and pushing policies that would make it even worse, liberals emphasizing the need for education and skills development, and leftists pushing for a unionized labor market and social-democratic welfare state.

Some of these ideas are good ones, which would make life better for vulnerable people. But they’d do little to directly target inequality in our society or to capture all the benefits that economic fairness brings.

The solution is simpler than it seems. There’s a tried and tested way, within the system we have now, of giving everyone a share in the investment returns now hoarded by the wealthy. It’s called a social wealth fund, a pool of investment assets in some ways like the giant index or mutual funds already popular with retirement savings accounts or pension funds, but one owned collectively by society as a whole. One that paid dividends not to the few, or even just to the shrinking middle class lucky enough to have their savings invested, but to everyone.

It may be our best chance to stop a decades-long trend of rising wealth inequality that has only accelerated since the Great Recession. According to new data released by the Federal Reserve, the collapse of the housing bubble and the ensuing financial crisis caused the net worth of virtually all families, rich and poor, to drop sharply between 2007 and 2010. But during the post-2010 economic recovery, the fortunes of the wealthiest grew rapidly while nearly everyone else’s lagged behind.

The wealth of the top 1 percent increased by an average of $4.9 million over the past decade, while the average holdings of the bottom 99 percent declined by about $4,500. Wealth inequality is now the highest it has been since the Federal Reserve began collecting this kind of data in 1983. A full account of just how bad things have gotten is difficult to wrap one’s mind around. In 2016, according to my calculations, the top 1 percent had an average wealth of $26.6 million, while the net worth of everyone in the bottom third combined was less than zero (because of a mixture of low accumulated savings and high debt).

The stress this puts on our society is hard to overstate, and though recognition of our country’s grossly unequal condition has grown in recent years, few have proposed credible ways of turning things around. That’s where a social wealth fund comes in.

Pope Francis: Quotations On Finance, Economics, Capitalism And Inequality

Pope Francis: One Of The Most Powerful Critiques Of Capitalism You Will Ever Read

Pope Francis: Quotations On Finance, Economics, Capitalism And Inequality

Pope Francis: One Of The Most Powerful Critiques Of Capitalism You Will Ever ReadPope Francis: "This Economy Kills"

http://paxonbothhouses.blogspot.com/2015/01/pope-francis-this-economy-kills.html

"Pope Francis Links"

Here’s how it could work. The federal government would create and run a new investment fund, and issue every adult citizen one share of ownership. The fund would gradually come to own a substantial and diverse portfolio of stocks, bonds and real estate. The investment return that the fund generates would be paid out to each citizen in the form of a universal basic dividend, and the shares would be nontransferable to preserve the institution’s egalitarian purpose.

The net result of such a system would be to gradually transform private wealth, which is very unevenly distributed, into public wealth that every person in society owns an equal part of. If, over time, the social wealth fund came to own one-third of the country’s wealth, that would allow it to distribute an annual dividend equivalent to about a third of the total returns on invested capital each year, which represents about a tenth of net national income. In 2016, based on the latest available census population figures, that would have meant around $6,400 paid to all adults or $8,000 paid to every person between the ages of 18 and 64.

Over the past few decades, wealth funds like this have been successfully implemented in Alaska and Norway, quashing any doubt about their practical viability. Alaska’s fund was created in 1976 under the Republican Governor Jay Hammond and has grown in value to $62 billion. In a typical year, every Alaskan citizen, including children, receives a dividend from the fund of about $1,000 to $2,000. Norway’s similar fund recently topped $1 trillion in value and, in the last quarter alone, generated $23 billion of investment return, or about $4,500 per Norwegian. Unlike Alaska, Norway uses its fund not to directly pay out dividends but as a source of revenue for its famously generous welfare state.

The idea has a long history. Thomas Paine advocated the creation of a similar “national fund” in his 1797 pamphlet “Agrarian Justice.” Socialist economists have supported it as well. Oskar Lange wrote in favor of the concept in 1936, and Rudolf Hilferding described the socialization of financial assets as “the ultimate phase of the class struggle between bourgeoisie and proletariat” in 1910.

In more recent times, more and less robust versions of the idea have been endorsed by the Nobel Prize-winning economist James Meade, the former Greek Finance Minister Yanis Varoufakis and even Hillary Clinton in her 2016 campaign memoir. It would be hard to claim it’s some sort of utopian fantasy.

Alan: One intractable hindrance to the implemenation of a "social wealth fund" is that morality, as conceived by American conservatives, requires that n'er-do-wells be punished for "not carrying their own weight." The simplest way to insure their punishment (and thus validate the constancy of God's eternal "justice") is to provide NO public benefit to "riff-raff," thus insuring their early death, if only from lack of healthcare. In the conservative view, God can only be demonstrably just if "He" enforces a terrestrial adumbration of the unspeakable punishment that awaits "The Damned."

"The Hard, Central Truth Of Contemporary Conservatism"

The key challenge in building a social wealth fund is not how to run it once it has been created, but how to bring assets into the fund in the first place. Alaska and Norway were able to dedicate the proceeds from natural resource exploitation to that purpose, but most governments seeking to duplicate their efforts would need to look elsewhere for the money.

Wouldn’t the enormous wealth that our increasingly productive society is generating, which now flows into just a few pockets, be a fair source? Some of the concrete ways this could happen are through the transfer of existing federal assets like land, buildings and portions of the wireless spectrum into the new fund. Other measures could include increases in taxes on capital that affect mostly the wealthy such as estate, dividend and financial transaction taxes and the creation of a new type of corporate tax that requires companies to directly issue new shares to the social wealth fund on an annual basis and during certain corporate moves such as initial public offerings, mergers and acquisitions.

Another way to bring assets into the fund would be to modify the way the Federal Reserve pumps money into the economy. Currently, the central bank does that by buying up Treasury bonds. If instead we used newly created money to buy up stocks that are then deposited into the social wealth fund, it would gradually socialize wealth ownership without the need to raise taxes on anyone. As Roger Farmer and Miles Kimball have argued, these kinds of asset purchases could also be ramped up during recessions, allowing the federal government to acquire significant portions of the national wealth relatively cheaply while also stabilizing financial markets and stimulating the economy.

Creating a social wealth fund in which we all own an equal part is certainly not the only way to tackle wealth inequality directly, but it is one of the few ways that we know works well and is able to work within the system we now have. If policymakers want to get serious about trimming wealth concentration, and not just use these shocking statistics to promote the same old half-measures, then this would be a fair, effective and practical way to start.

No comments:

Post a Comment