Steve Cohen, Hedge Fund Billionaire

The 106th Richest Man In The World

Wikipedia

https://en.wikipedia.org/wiki/Steven_A._Cohen

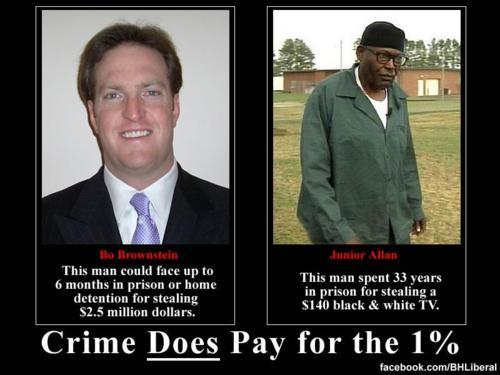

Alan: The movers and shakers of high finance do whatever they want in full knowledge they'll get away with "it."

Occasional fines are in no way dissuasive since magnates factor them into the 'cost of doing business."

The "Big Boys (and Girls)" are fully aware the loftiest fine is minuscule percentage of their illegal booty.

From the meretricious vantage of Wall Street, they would be fools not to pay punitive pennies on the dollar.

Here's how it works.

So much for that lifetime ban of hedge-fund billionaire Steve Cohen.

The Securities and Exchange Commission reached a settlement with Cohen on Friday that allows the star investor to return to managing client money in 2018.

It's a big win for Cohen, who had been facing a lifetime ban under the original charges filed by the SEC.

Not only that, but Cohen -- whose personal net worth is estimated at $12 billion -- also avoided a financial penalty.

The SEC found that Cohen failed to supervise former portfolio manager Mathew Martoma, who the agency says engaged in insider trading in 2008 while working at Cohen's hedge fund SAC Capital. The firm pled guilty in 2013. Regulators also say Cohen ignored red flags that should have caused him to take action.

Under the terms of the deal, Cohen is banned from serving in a supervisory role at any broker, dealer or investment adviser until 2018 and must retain an independent consultant.

Andrew Ceresney, director of the SEC's enforcement division, said the punishment achieves "significant and immediate investor protection and deterrence."

Still, it's a dramatic scaling back by the SEC, which was hampered by the loss of a key court ruling.

In a memo to employees at his investment firm Point72 that was obtained by CNNMoney, Cohen said the decision to settle gives his firm certainty and opens the possibility of raising outside capital in the future.

"The longer the pending litigation lingered, the more it distracted from the world-class firm that we are building," Cohen wrote.

Cohen said the settlement doesn't mean it's a time to be "complacent" and promised his firm would continue to do business at the "highest ethical and professional levels."

No comments:

Post a Comment