"Inside Job"

Oscar Winning Documentary

Free online - with Spanish subtitles.

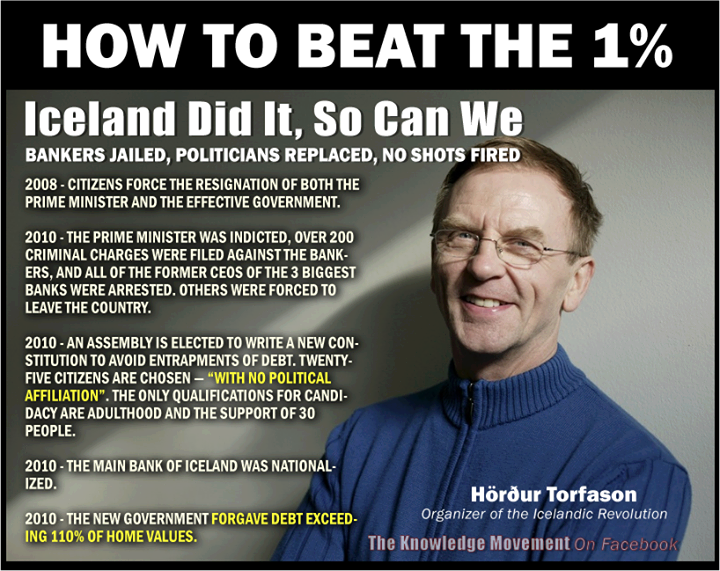

The first five minutes of this Oscar-winning documentary detail the collapse of the Icelandic economy.

Review: "Inequality For All" By Robert Reich

Republican Rule And Economic Catastrophe, A Lockstep Relationship

Inequality: Joseph Stiglitz Brilliant Reflection On Obama's State Of The Union Address

Leona Helmsley, "The Queen of Mean"

Leona Helmsley, "The Queen of Mean"

Felon

Income Tax Evasion

http://en.wikipedia.org/wiki/Leona_Helmsley

Inequality: Joseph Stiglitz Brilliant Reflection On Obama's State Of The Union Address

Felon

Income Tax Evasion

http://en.wikipedia.org/wiki/Leona_HelmsleyObama vs. the 1 percent

The president’s tax plan would actually help reduce inequality

January 22, 2015

President Barack Obama isn’t kidding when he says the tax proposals he outlined in his State of the Union address would have an effect on inequality in the United States.

In seeking to pay for measures aimed at helping the middle class, Mr. Obama has focused on reining in two big tax breaks for the top 1 percent.

The first applies to stock dividends and long-term investment gains, which are taxed at a rate of no more than 20 percent (plus a 3.8 percent surtax for very high earners), compared with as much as 39.6 percent for ordinary income. The second is a loophole that excludes investment gains on property transferred at death, allowing heirs to avoid a big tax bill.

Taken together, the capital-gains and inheritance-tax breaks were worth more than $200 billion in 2013, the Congressional Budget Office estimated. The benefits accrued almost entirely to the rich: They boosted the after-tax income of the top 1 percent by more than 6 percent and had an almost negligible effect on the lowest-earning 40 percent of U.S. households.

The wealthy need not rush to call their tax planners. Mr. Obama’s proposals are highly unlikely to become law in today’s political environment. They also wouldn’t come close to eliminating the tax breaks. Mr. Obama would increase the top capital-gains rate only to 28 percent and would require heirs to pay tax only on investment gains exceeding $200,000 per couple.

That said, with inequality becoming a pressing issue, the idea of changing the way the U.S. taxes capital will undoubtedly resurface.

In a world in which everyone started with nothing and spent all their savings over their lifetimes, critics of the idea would be right to protest: Taxing wealth would probably inhibit the investment needed for the economy to grow. But in a world like ours, where wealth is increasingly concentrated in the hands of a few and incomes are stagnating for the vast majority of workers, taxing the former to ease the burden on the latter makes a lot more sense.

Mark Whitehouse writes on global economics and finance for Bloomberg View.

***

Alan: Consider the most remarkable thing said by a Founding Father.

Benjamin Franklin to Robert Morris:

On Taxes

25 December, 1783

"The Remissness of our People in Paying Taxes is highly blameable; the Unwillingness to pay them is still more so. I see, in some Resolutions of Town Meetings, a Remonstrance against giving Congress a Power to take, as they call it, the People's Money out of their Pockets, tho' only to pay the Interest and Principal of Debts duly contracted. They seem to mistake the Point. Money, justly due from the People, is their Creditors' Money, and no longer the Money of the People, who, if they withold it, should be compell'd to pay by some Law. All Property, indeed, except the Savage's temporary Cabin, his Bow, his Matchcoat, and other little Acquisitions, absolutely necessary for his Subsistence, seems to me to be the Creature of public Convention. Hence the Public has the Right of Regulating Descents, and all other Conveyances of Property, and even of limiting the Quantity and the Uses of it. All the Property that is necessary to a Man, for the Conservation of the Individual and the Propagation of the Species, is his natural Right, which none can justly deprive him of: But all Property superfluous to such purposes is the Property of the Publick, who, by their Laws, have created it, and who may therefore by other Laws dispose of it, whenever the Welfare of the Publick shall demand such Disposition. He that does not like civil Society on these Terms, let him retire and live among Savages. He can have no right to the benefits of Society, who will not pay his Club towards the Support of it."

"Plutocracy Triumphant"

Cartoon Compendium

"Politics And Economics: The 101 Courses You Wish You Had"

"Politics And Economics: The 101 Courses You Wish You Had"

"Taibbi: The $9 Billion Whistle Blower At JPMorgan-Chase. Financial Thuggery At The Top"

http://paxonbothhouses.

"The Rich Aren't Just Grabbing A Bigger Slice Of The Pie. They're Taking It All"

http://paxonbothhouses.

"The Rich Aren't Just Grabbing A Bigger Slice Of The Pie. They're Taking It All"

http://paxonbothhouses.

http://paxonbothhouses.

Major General Smedley Butler: Do Wars Really Defend America’s Freedom?

G.K. Chesterton: "The Anarchy of The Rich"

G.K. Chesterton and Warren Buffett's Class War

G.K. Chesterton: "The Anarchy of The Rich"

G.K. Chesterton and Warren Buffett's Class War

"War, Peace And Political Manipulation: Quotations"

"War, Peace And Political Manipulation: Quotations"

"Pope Francis Links"

"Pope Francis Links"

No comments:

Post a Comment