1910 Income Tax Promised To Never Shift Burden From Richest 1 - 4%

U Mass Professor Emeritus Richard Wolff Provides Out-Of-The-Box Views

How More and More U.S. Corporate Profits Escape the Corporate Income Tax

Workers pay, the big guys get tax breaks and even subsidies!

By John Miller. Originally published at Triple Crisis

Yves here. This post makes an important and simple point about one big source of the fall in the relative importance of corporate income as a source of Federal tax revenue that is often ignored in official discussions: the rise in the use of pass-through entities. An older theory was that, generally speaking, you could get the benefits of limited liability and pass through treatment only if you were a small fry. The S corporation election was meant to promote entrepreneurial activity. If you want to be a partnership and get the tax bennies, fine, but you have to live with the risk of unlimited personal liability.

The use of limited liability corporations started to pick up steam in the later 1990s (I recall asking my regular attorney about converting to an LLC in 1997 and she thought they were too untested legally to be worth the risk) and are now common. And the impact over time of this change, as well as the use of other tax-reduction strategies, has been significant. In 1952, corporate income tax provided 33% of total Federal tax receipts. By 2013, it had fallen to 10%.

The effective corporate income tax rate is almost exactly the same in the United States as in other OECD countries. (While the U.S. statutory corporate tax rate is well above the OECD average, the many loopholes in the U.S. corporate tax bring the effective rate down substantially.) Then how is it that corporate taxes account for a much smaller share of GDP in the United States than in other high-income countries? The answer lies in forms of incorporation that allow U.S. corporate profits to be taxed at the lower individual income tax rate.

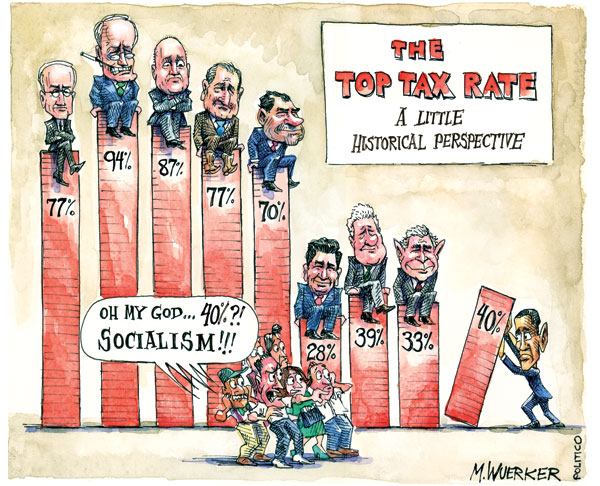

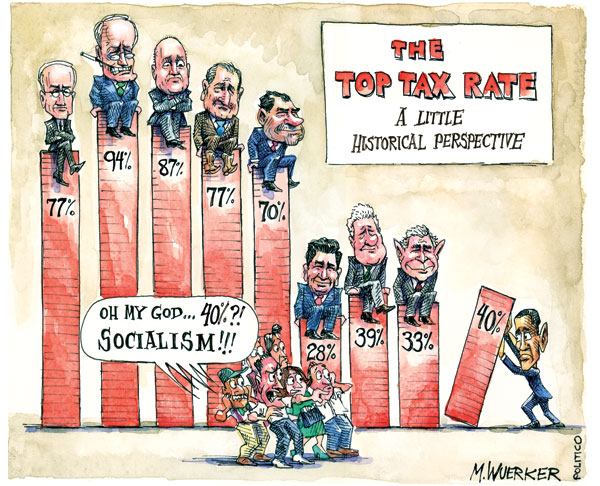

Two changes paved the way for more and more profit to escape the corporate income tax in the United States. The federal government extended limited legal liability, which protects owners from losing their personal assets if their business fails, to some partnerships and “pass through” corporations not subject to the corporate income tax. Then the tax reform of 1986 cut the top tax bracket of the individual income tax to 28%, well below the statutory corporate income-tax rate. That opened up a large tax advantage for owners who paid individual income taxes on their profits instead of corporate income taxes.

Pass-through businesses—-S-corporations (which afford up to 100 owners limited liability), partnerships (including limited liability partnerships in which all the partners enjoy limited liability), and sole proprietorships—-have flourished over the last three decades. In 1980, corporations subject to the corporate income tax (called “C-corporations”) generated nearly four fifths (78%) of business net income, a measure of a business’s profitability. By 2007, pass-through businesses’ share of net income surpassed that of C-corporations. In fact, partnerships, S-corporations, and sole proprietorships each outnumbered C-corporations.

That was not the case in other high-income countries. In 2004, for instance, nearly two-thirds of U.S. businesses with taxable profits over $1 million were not subject to the corporate income tax. Meanwhile the next-highest share among large, high-income countries belonged to the United Kingdom, with just 26%.

The three-decade decline in the corporate share of net income, enabled by the rise in pass-through businesses with limited liability, has eroded the tax base for the U.S. corporate income tax. That explains how U.S. corporate income tax receipts as a share of GDP (2.3% in 2011) were able to drop well below OECD average (3.0% in 2011), even while the U.S. and OECD effective tax rates on corporate income were nearly identical.

Today, the majority of business profits are taxed at an even lower rate than that imposed by a corporate code riddled with loopholes. A thorough-going reform of taxes on profits must therefore not only close loopholes in the corporate income tax but also no longer extend limited liability to businesses that don’t pay corporate income taxes. With the profits of S-corporations and limited liability companies added to its base, the corporate income tax would be extended to at least another one-fifth of business net income. No longer extending limited liability to millionaire owners of S-corporations and limited liability companies, by itself, would add more than one-tenth of business net income to the base of the corporate income tax.

No comments:

Post a Comment