Depression Bread Line

The Issues:

1.) Markets are spooked by uncertainty.

2.) Capitalists invest more heavily when taxes are low.

3.) American jobs are being shipped overseas.

Postulates:

We know that tax policy can achieve desirable outcomes.

Case in Point: In Ireland, the imposition of a hefty tax on plastic bags achieved the desired end of drastically reduced bag consumption: a precipitous decline of 94% in just weeks. http://www.nytimes.com/

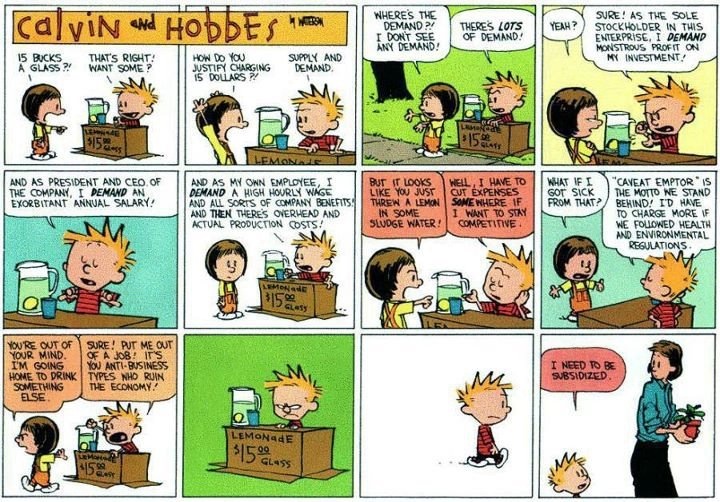

The Rule is for tax rates and job creation operate in inverse relationship.

More job growth, lower taxes.

Less job growth, higher taxes.

This is not rocket science.

That said, the very workability of the plan may be a liability in a world designed to benefit The 5% while impeding The Common Good.

Plan:

Devise legislation that guarantees - in perpetuity - a maximum capital gains tax of 15% on investment in "growth companies" whose employee base is more than 75% American. (I'm open to different tax rates: 10%? 7.5%? 5%? I'm also open to different percentages of "American hires": 65%? 50%?)

Such legislation 1.) eliminates uncertainty, 2.) keeps the capital gains tax predictably-and-permanently low, and 3.) fosters the creation of American jobs.

When a "growth company" loses its "listing" as a "growth company" -- or, when a growth company no longer hires the specified minimum number of American employees -- its investors will no longer benefit from a guaranteed capital gains tax that is favorable to them.

Investors can, of course, re-invest in newly-designated "growth companies" - assuming these companies also meet the American hiring stipulation.

Or, investors can retain their existing investment knowing that the capital gains rate may rise.

This capital gains tax incentive can be synergized by granting corporate tax rate reductions to any company according to the number of new American jobs produced each tax year; perhaps a 1% reduction in tax for each 1% increase in American "hires."

If nothing else, these proposals will stir political debate that will provide citizens with economic insight while redounding to the political benefit of whichever party makes these proposals first.

Most importantly, "America wins."

What's not to like?

Addenda

1.) Naysayers will argue that the definition of "growth company" cannot be accurately ascertained. Clearly, "definition" is problematic. Nevertheless, Wall Street routinely defines "growth companies" as evidenced by the popularity of "growth company" mutual funds. It is an inescapable responsibility that humans make "judgment calls." To make such "calls" in the context of the legislative proposal above, there will be a standing committee comprised of "5" Wall Street bigwigs and "5" Treasury/Commerce officials who will determine, by simple majority vote, which companies comply with previously agreed-upon "growth" criteria. This committee will meet annually to update the list of Growth Companies.

2.) Automation, robotization and ongoing software-based "productivity enhancement" will continue to eliminate jobs - at least jobs as traditionally defined. A fringe benefit of "investing in growth companies" is that nascent enterprise requires more workers than mature industry requires since automation, robotization and software-based productivity develop over time.

3.) The quickest way to understand the self-destructive dysfunction of highly-financialized, predatory capitalism, is to watch "Inside Job," the 2010 Oscar winner for "Best Documentary." It is freely available online at http://watchdocumentaries.com/inside-job/

4.) "The Coming Class War," a Newseek article profiling George Soros

http://www.thedailybeast.com/newsweek/2012/01/22/george-soros-on-the-coming-u-s-class-war.html

5.) "Cash Cow" companies whose profitable business model is a settled fact may not want to foster "job growth." In such cases, hike the cash cow's tax rate to the point where it becomes preferable to "create jobs" (perhaps in promising research and development) than to pay the equivalent of those salaries in the form of taxes. The Rule -- as always -- is to have tax rates and job creation function in inverse relationship. More job growth, lower taxes.

5.) "Cash Cow" companies whose profitable business model is a settled fact may not want to foster "job growth." In such cases, hike the cash cow's tax rate to the point where it becomes preferable to "create jobs" (perhaps in promising research and development) than to pay the equivalent of those salaries in the form of taxes. The Rule -- as always -- is to have tax rates and job creation function in inverse relationship. More job growth, lower taxes.

Abraham Lincoln: "In my present position I could scarcely be justified were I to omit raising a warning voice against this approach of returning despotism. It is not needed nor fitting here that a general argument should be made in favor of popular institutions, but there is one point, with its connections, not so hackneyed as most others, to which I ask a brief attention. It is the effort to place capital on an equal footing with, if not above, labor in the structure of government. It is assumed that labor is available only in connection with capital; that nobody labors unless somebody else, owning capital, somehow by the use of it induces him to labor. This assumed, it is next considered whether it is best that capital shall hire laborers, and thus induce them to work by their own consent, or buy them and drive them to it without their consent. Having proceeded so far, it is naturally concluded that all laborers are either hired laborers or what we call slaves. And further, it is assumed that whoever is once a hired laborer is fixed in that condition for life. Now there is no such relation between capital and labor as assumed, nor is there any such thing as a free man being fixed for life in the condition of a hired laborer. Both these assumptions are false, and all inferences from them are groundless. Labor is prior to and independent of capital. Capital is only the fruit of labor, and could never have existed if labor had not first existed. Labor is the superior of capital, and deserves much the higher consideration." Read more: State of the Union Address: Abraham Lincoln (December 3, 1861) — Infoplease.com http://www.

Benjamin Franklin to Robert Morris

25 December, 1783

"The Remissness of our People in Paying Taxes is highly blameable; the Unwillingness to pay them is still more so. I see, in some Resolutions of Town Meetings, a Remonstrance against giving Congress a Power to take, as they call it, the People's Money out of their Pockets, tho' only to pay the Interest and Principal of Debts duly contracted. They seem to mistake the Point. Money, justly due from the People, is their Creditors' Money, and no longer the Money of the People, who, if they withold it, should be compell'd to pay by some Law.

All Property, indeed, except the Savage's temporary Cabin, his Bow, his Matchcoat, and other little Acquisitions, absolutely necessary for his Subsistence, seems to me to be the Creature of public Convention. Hence the Public has the Right of Regulating Descents, and all other Conveyances of Property, and even of limiting the Quantity and the Uses of it. All the Property that is necessary to a Man, for the Conservation of the Individual and the Propagation of the Species, is his natural Right, which none can justly deprive him of: But all Property superfluous to such purposes is the Property of the Publick, who, by their Laws, have created it, and who may therefore by other Laws dispose of it, whenever the Welfare of the Publick shall demand such Disposition. He that does not like civil Society on these Terms, let him retire and live among Savages. He can have no right to the benefits of Society, who will not pay his Club towards the Support of it."

Teddy Roosevelt: “Too much cannot be said against the men of wealth who sacrifice everything to getting wealth. There is not in the world a more ignoble character than the mere money-getting American, insensible to every duty, regardless of every principle, bent only on amassing a fortune, and putting his fortune only to the basest uses —whether these uses be to speculate in stocks and wreck railroads himself, or to allow his son to lead a life of foolish and expensive idleness and gross debauchery, or to purchase some scoundrel of high social position, foreign or native, for his daughter. Such a man is only the more dangerous if he occasionally does some deed like founding a college or endowing a church, which makes those good people who are also foolish forget his real iniquity. These men are equally careless of the working men, whom they oppress, and of the State, whose existence they imperil. There are not very many of them, but there is a very great number of men who approach more or less closely to the type, and, just in so far as they do so approach, they are curses to the country." Theodore Roosevelt - February, 1895 - http://books.google.com/

Reagan Budget Director, David Stockman, who oversaw the biggest tax cut in the history of humankind: “In 1985, the top five percent of the households – the wealthiest five percent – had net worth of $8 trillion – which is a lot. Today, after serial bubble after serial bubble, the top five per cent have net worth of $40 trillion. The top five percent have gained more wealth than the whole human race had created prior to 1980.” Elsewhere in this same CBS “60 Minutes” interview, Mr. Stockman describes America's obsession with tax cuts as "religion, something embedded in the catechism," "rank demagoguery, we should call it what it is," and "We've demonized taxes. We've created... the idea that they're a metaphysical evil." And finally, this encompassing observation: "The Republican Party, as much as it pains me to say this, should be ashamed of themselves." - http://www.

Major General, Marine Commandant Smedley Butler on Interventionism

-- Excerpt from a speech delivered in 1933

War is just a racket. A racket is best described, I believe, as something that is not what it seems to the majority of people. Only a small inside group knows what it is about. It is conducted for the benefit of the very few at the expense of the masses.

I believe in adequate defense at the coastline and nothing else. If a nation comes over here to fight, then we'll fight. The trouble with America is that when the dollar only earns 6 percent over here, then it gets restless and goes overseas to get 100 percent. Then the flag follows the dollar and the soldiers follow the flag.

I wouldn't go to war again as I have done to protect some lousy investment of the bankers. There are only two things we should fight for. One is the defense of our homes and the other is the Bill of Rights. War for any other reason is simply a racket.

There isn't a trick in the racketeering bag that the military gang is blind to. It has its "finger men" to point out enemies, its "muscle men" to destroy enemies, its "brain men" to plan war preparations, and a "Big Boss" Super-Nationalistic-

It may seem odd for me, a military man to adopt such a comparison. Truthfulness compels me to. I spent thirty- three years and four months in active military service as a member of this country's most agile military force, the Marine Corps. I served in all commissioned ranks from Second Lieutenant to Major-General. And during that period, I spent most of my time being a high class muscle- man for Big Business, for Wall Street and for the Bankers. In short, I was a racketeer, a gangster for capitalism.

I suspected I was just part of a racket at the time. Now I am sure of it. Like all the members of the military profession, I never had a thought of my own until I left the service. My mental faculties remained in suspended animation while I obeyed the orders of higher-ups. This is typical with everyone in the military service.

I helped make Mexico, especially Tampico, safe for American oil interests in 1914. I helped make Haiti and Cuba a decent place for the National City Bank boys to collect revenues in. I helped in the raping of half a dozen Central American republics for the benefits of Wall Street. The record of racketeering is long. I helped purify Nicaragua for the international banking house of Brown Brothers in 1909-1912 (where have I heard that name before?). I brought light to the Dominican Republic for American sugar interests in 1916. In China I helped to see to it that Standard Oil went its way unmolested.

During those years, I had, as the boys in the back room would say, a swell racket. Looking back on it, I feel that I could have given Al Capone a few hints. The best he could do was to operate his racket in three districts. I operated on three continents.

In his lifetime, Major General Butler was the most decorated Marine ever.

In retirement, General Butler, a life-long Republican, ran for a Pennsylvania Senate seat.

Pat Buchanan (the living American who has spent most time inside the White House): "The Republican philosophy might be summarized thus: To hell with principle; what matters is power, and that we have it, and that they do not.” "Where the Right Went Wrong" - http://www.amazon.com/Where-

"The terrible thing about our time is precisely the ease with which theories can be put into practice. The more perfect, the more idealistic the theories, the more dreadful is their realization. We are at last beginning to rediscover what perhaps men knew better in very ancient times, in primitive times before utopias were thought of: that liberty is bound up with imperfection, and that limitations, imperfections, errors are not only unavoidable but also salutary. The best is not the ideal. Where what is theoretically best is imposed on everyone as the norm, then there is no longer any room even to be good. The best, imposed as a norm, becomes evil.” Conjectures of a Guilty Bystander - http://en.wikipedia.org/wiki/

G.K. Chesterton: The merely rich are not rich enough to rule the modern market. The things that change modern history, the big national and international loans, the big educational and philanthropic foundations, the purchase of numberless newspapers, the big prices paid for peerages, the big expenses often incurred in elections - these are getting too big for everybody except the misers; the men with the largest of earthly fortunes and the smallest of earthly aims. There are two other odd and rather important things to be said about them. The first is this: that with this aristocracy we do not have the chance of a lucky variety in types which belongs to larger and looser aristocracies. The moderately rich include all kinds of people even good people. Even priests are sometimes saints; and even soldiers are sometimes heroes. Some doctors have really grown wealthy by curing their patients and not by flattering them; some brewers have been known to sell beer. But among the Very Rich you will never find a really generous man, even by accident. They may give their money away, but they will never give themselves away; they are egoistic, secretive, dry as old bones. To be smart enough to get all that money you must be dull enough to want it. G. K. Chesterton - http://

The coming peril is the intellectual, educational, psychological and artistic overproduction, which, equally with economic overproduction, threatens the wellbeing of contemporary civilisation. People are inundated, blinded, deafened, and mentally paralysed by a flood of vulgar and tasteless externals, leaving them no time for leisure, thought, or creation from within themselves. G. K. Chesterton Toronto, 1930 - http://alanarchibald.

“[W]hat was the matter with the doctrine of laissez-faire was not that it believed that liberty could preserve equality, where there was none to preserve. It was that it preached liberty, or rather license, to increase an inequality that was already hopelessly unequal.” – G.K. Chesterton, Some Distinctions -http://

Adolf Hitler: "All this was inspired by the principle--which is quite true within itself--that in the big lie there is always a certain force of credibility; because the broad masses of a nation are always more easily corrupted in the deeper strata of their emotional nature than consciously or voluntarily; and thus in the primitive simplicity of their minds they more readily fall victims to the big lie than the small lie, since they themselves often tell small lies in little matters but would be ashamed to resort to large-scale falsehoods. It would never come into their heads to fabricate colossal untruths, and they would not believe that others could have the impudence to distort the truth so infamously. Even though the facts which prove this to be so may be brought clearly to their minds, they will still doubt and waver and will continue to think that there may be some other explanation. For the grossly impudent lie always leaves traces behind it, even after it has been nailed down, a fact which is known to all expert liars in this world and to all who conspire together in the art of lying." Adolf Hitler , Mein Kampf, vol. I, ch. X [1] http://en.wikipedia.org/wiki/

Al Capone

The Golden Calf is the same idol now as it was at the foot of Mount Sinai.

America's worship of wealth will not end well.

"It seems to me there are very dangerous ambiguities about our democracy in its actual present condition. I wonder to what extent our ideals are now a front for organized selfishness and irresponsibility. If our affluent society ever breaks down and the facade is taken away, what are we going to have left?" Thomas Merton -

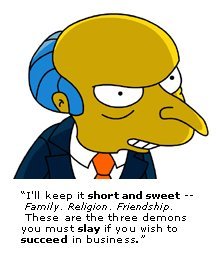

An Indisputable Assertion:

Capitalism Makes Lots Of People Rich

Now what?

Capitalism Is So Effective

It Can Profit From Anything

Now what?

Effective Regulation Perhaps?

Frank recognition that “Taxes are the price we pay for Civilization?”

No comments:

Post a Comment