Posted on April 15, 2014

Q: Did Democrats increase federal income tax rates in 2014 under Obamacare?

A: No. Tax increases mentioned in a viral email went into effect a year earlier, as part of a budget deal supported by many Republicans as well as most Democrats.

FULL QUESTION

Is this information correct? I have tried to check it out but get terribly confused.

It came as an email from a friend in Colorado.

Viral email: THE FIRST THREE MONTHS!

Happy New Year America

Here is what happened on January 1st 2014:

Top Income Tax bracket went from 35% to 39.6%

Top Income Payroll Tax went from 37.4% to 52.2%

Capital Gains Tax went from 15% to 28%

Dividend Tax went from 15% to 39.6%

Estate Tax went from 0% to 55%

Remember this ‘fact;’ if you have any money, the Democrats want it! All these taxes were passed with only Democrat votes. Not one Republican voted to do these taxes. Remember this come election time. And make sure your friends and neighbors know this info too!

These taxes were all passed under the affordable care act, otherwise known as Obama care.

FULL ANSWER

We started getting dozens of queries about this one about three weeks before tax filing day. It’s nonsense. Some of these figures aren’t accurate, and none of these increases took effect on Jan. 1, 2014, or had anything to do with the Affordable Care Act. And the claim that “not one Republican voted to do these” is false.

Here’s what really happened, and when:

- The top income tax rate went back up to 39.6 percent over a year ago — for singles making more than $400,000 a year or couples making more than $450,000. The increase was part of the “fiscal cliff” package that Congress passed on New Year’s Day of 2013.

- Capital gains rates also increased in 2013 under the same “fiscal cliff” deal — but not nearly as much as this email claims. For long-term gains (on assets held more than one year) the top rate went from 15 percent to 20 percent (not 28 percent), and also applied to individuals making more than $400,000 and couples earning more than $450,000.

- The top rate for dividends also went up to 20 percent (not 39.6 percent) in 2013 as part of the same fiscal cliff package, and also only for those with more than $400,000 individual or $450,000 joint taxable income.

- It’s true that the estate tax was once effectively zero percent — but only for people who died in 2010, not last year. The top rate went back up to 35 percent for those who died the following year, and (under the fiscal cliff deal) to 40 percent for those who died in 2012 and thereafter. Furthermore, the rate is still zero percent for any individual who dies this year and whose estate is valued at less than $5,340,000. The threshold for filing an estate-tax return was set at $5 million in 2011, and is indexed for inflation each year.

- The claim that the fiscal-cliff tax increases were “passed with only Democratic votes” is false. The deal passed by a vote of 89-8 in the Senate (including 40 Republican votes in favor) and by a vote of 257-167 in the House (with 85 Republican votes in favor). The package made permanent the 2001 Bush tax cuts for all but very high-income earners, avoiding tax increases that otherwise would have taken effect Jan. 1, 2013, when the “temporary” Bush tax cuts were scheduled to expire.

The email’s claim about “income payroll tax” is a head-scratcher, since no tax expert we know of uses such a term. Our best guess is that the anonymous author meant to refer to the combined effect of the federal income tax and the Social Security and Medicare payroll taxes, and did not understand how these taxes work. No combination of payroll and federal income taxes would produce a top marginal rate of 52.2 percent, so far as we can figure.

Back in 2008, when Obama was first running for president, conservative commentator

Larry Kudlow claimed that Obama’s tax proposals would amount to “a 52.2 percent combined income and payroll tax.” But even

that claim was wrong, because of the simple fact that the top marginal income-tax rate applied at that time only to income above $349,701 and Social Security taxes applied only to wage or salary income below $97,500. Any income taxed at the top income-tax rate would incur zero Social Security tax.

And the same is true today:

Taxable Social Security wages now stop at $117,000, and the top marginal income-tax bracket doesn’t kick in until $406,751 for singles and $457,601 for joint filers. All of these levels are adjusted for inflation each year.

– Brooks Jackson

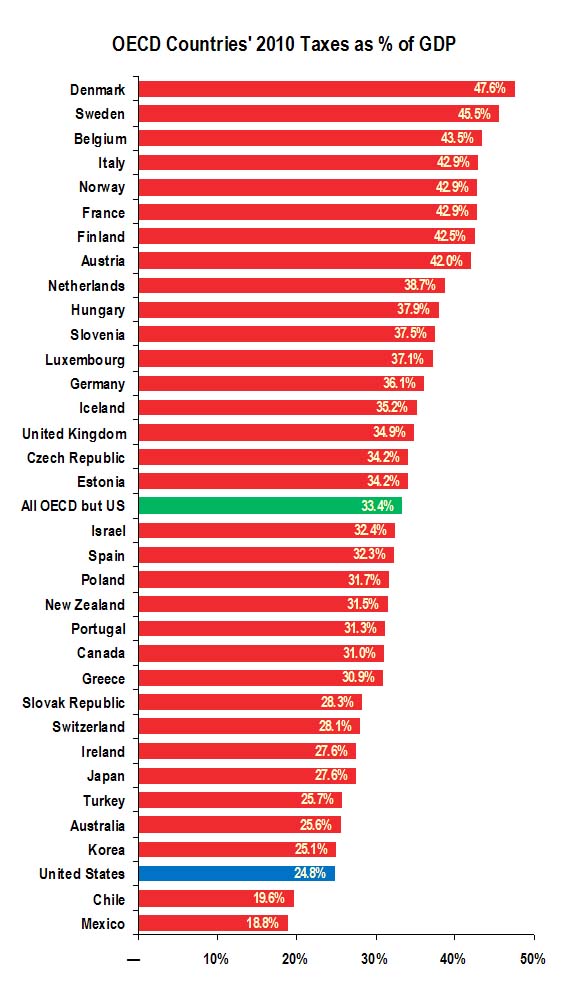

Notice that the highest taxes are paid in countries that are great places to live.

***

Foreign Aid As Percentage Of Gross National Income, By Country

Sources

U.S. Internal Revenue Service. “

Estate Tax” Web page. 9 Apr 2014.

No comments:

Post a Comment