The Obamacare cancellation stories have dominated the media for the past two weeks. And it’s easy to understand why. People losing their insurance is a bigger story than people getting insurance for the first time—particularly when the folks losing coverage remember, quite distinctly, the president vowing they can keep their insurance if they like it.

At least some of these tales are precisely what they seem to be—stories of people paying more for less coverage, or facing increases that put real strains on their budgets, or moving to plans that don’t provide access to the same doctors and hospitals. You've read some of their tales in this space. These people are angry and feel deceived. That’s a totally legitimate story.

But how big a story should it be? To answer that, you need to know how many people actually fit these descriptions—and what might have happened to these people if the Affordable Care Act had never become law. It's impossible to answer either question with certainty, because reliable statistics aren’t available and there's no time machine for seeing how alternative futures might play out. But there are at least six reasons to think the real story is smaller—and way more complicated—than a credulous media would have everybody believe.

1. PEOPLE WITH THESE POLICIES FREQUENTLY DON’T LIKE THEM.

The best estimates suggest that about 12 to 15 million people buy insurance on their own. In other words, they are part of the “non-group” market. So far, according to several media reports, about 5 million of these people have received cancellation notices. The final number will likely be higher. But it’s not as if most people with these policies feel particularly attached to them.

The best survey on this subject I’ve seen comes from the Center for Health Research and Transformation. In it, nearly half of all people surveyed rated their non-group coverage “fair or poor.” The proportion of respondents who had the same thing to say about employer coverage, Medicare, or Medicaid was half as high. This isn't particularly surprising, given that the most egregious insurance company abuses—rescinding policies for people who get sick, failing to pay for services that beneficiaries assumed were covered—usually come from the non-group market.

2. PEOPLE WITH THESE POLICIES DON’T TYPICALLY HAVE THEM FOR VERY LONG.

According to one Health Affairs study, half of the people in the non-group market stay in it for less than half a year, two-thirds stay in for less than a year, and four in five stay less than two years. Put another way, less than 20 percent of people in the non-group market hold onto their policies for more than two years. (See chart below.)

The data isn’t the same as a snapshot in time and it’s just one study, so don't take the specific figures too literally. But the overall point is clear: Most people are in the non-group market for a relatively short interval. It's coverage they get for a short spell, typically between jobs that provide coverage.

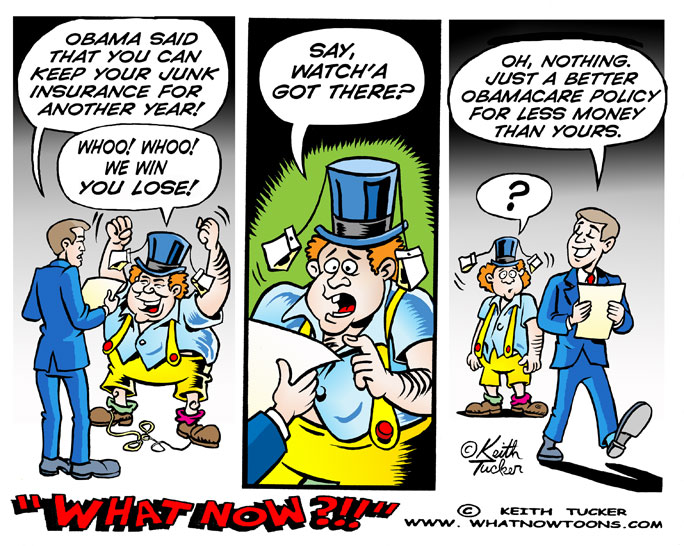

3. MANY, PROBABLY MOST PEOPLE WITH THESE POLICIES WILL FIND OBAMACARE POLICIES COST THEM LESS.

Obamacare’s regulation on benefits and pricing—the mandate to cover services like hospitalization, mental health, and maternity, plus the prohibition on declining people with pre-existing conditions—will tend to make insurance more expensive. But the law has generous subsidies. About half of the people who buy coverage now will be eligible for them, according to a study by the Kaiser Family Foundation. Others now buying non-group coverage will discover they are eligible for government insurance programs, chief among them Medicaid, or will end up with some other form of insurance (like an employer plan or, if they are under 26, their parents' insurance).

In the end, some people buying their own coverage now will end up paying more but it’s likely a larger number will end up paying less. (I say “likely” because this is a matter of some dispute. You can read all about it here.) And about those paying more? Read on...

4. THE PEOPLE GETTING WORSE DEALS TEND TO BE MORE AFFLUENT.

We can be certain of this for two reasons. First, if you buy your own coverage and the policy is decent, that means you have enough money to pay for one. Second, if you’re among those paying substantially more for coverage under Obamacare, that means you qualify for only low subsidies or no subsidies at all. By definition, your income is above the national median and probably way above the national median.

This certainly doesn’t mean you are rich, particularly if you live in a high-cost part of the country. But, given the range of policies available, you should be able to find some insurance that you can afford. (If not, the law allows you to buy either a catastrophic policy or to be exempt from the individual mandate.)

5. PAYING MORE FOR INSURANCE MIGHT MEAN PAYING LESS FOR MEDICAL CARE.

Stories about people paying more for their insurance next year typically focus only on premiums. Frequently their premiums go up because, next year, they must buy policies with more comprehensive benefits. But more comprehensive benefits mean you have better coverage—which means, if you get sick, you might actually end up spending less money. It won't work out this way every time, but usually it will. Lots of people think this is actually an improvement.

And that's not to mention what might happen to your insurance next year if you get sick, which brings us to...

6. JUST BECAUSE YOU LIKED YOUR POLICY THIS YEAR, THAT DOESN’T MEAN YOU’D LIKE IT NEXT YEAR.

Some people have held policies for several years, without exorbitant increases. That doesn’t mean they wouldn’t get hit with a big increase next year—or over the next few years. In fact, insurance carriers frequently used rate hikes to drive away customers as they got older and, inevitably, more prone to illness. Typically they would do this by raising rates for an entire "block," which is a group of people holding the same policy for the same set of prices.

Karen Pollitz, senior fellow at the Kaiser Family Foundation, explains how this has sometimes worked:

In the traditional market, virtually all states require that renewal rate increases must be uniform for all policyholders in a block. But insurers can close a block, starving it of influx of newly underwritten policyholders, so rates will spiral. Healthy people in the block will tend to bail because they can still pass underwriting and so move to other, more favorably rated policies. Sick people stranded in the block will all face the same rate increase at renewal, but it will spiral even more rapidly as risk profile of the block deteriorates.

Insurers can have even more leeway to raise rates when they sell to individuals through associations. Depending on the state, they can raise rates for particular members because of recent medical history. In other words, if you get sick one year, your rates can jump the next.

To sum up, lots of people losing coverage are losing policies they never liked much, that they would have dropped soon anyway, and that would have left them facing potential financial ruin if they got sick. Even those with truly good policies had no guarantees that in one year, let alone two or three, they'd still be able to pay for them.

It's impossible to specify exactly how many people are going to be better off in the new system or how many will feel better off. Those two things are not the same. But both groups are probably the majority of people with non-group insurance—and quite probably a large majority. That would suggest relatively few people are like the ones we're hearing and reading about so much in the media.

That doesn't mean the media or policymakers should ignore these people. Again, this is a very big country, which means even a very small percentage can number in the millions. But the media should give these stories the proper context—and put them in the proper perspective. Right now it isn't.

No comments:

Post a Comment