(Mark Wilson/Getty Images)

So much of the White House’s thinking about getting the health-care law right rests on one number: 2.7 million. That, as Ezra and I wrote last week, is the number of young adults between 18 and 35 who the White House thinks it needs to sign up for private health coverage next year. These young adults are at the heart of a powerpoint presentation that White House staffer David Simas showed us, which pinpoints where they live (largely in California, Texas and Florida) and what television stations they watch (Spike TV, for one). They’re the reason that Funny or Die’s Mike Farah flew in from California to spend Monday at the White House, hearing from Simas and Valerie Jarrett about the help they need in making Obamacare work.

“They really need the help,” he told me in an interview. “They’re obviously competing against an aggressive campaign against the law.”

So what do we know about these young people? Here are a few points that will be especially helpful to keep in mind as we keep talking about this demographic going forward.

There are 25 million people between 18 and 35 who are currently uninsured or purchase coverage in the individual market.

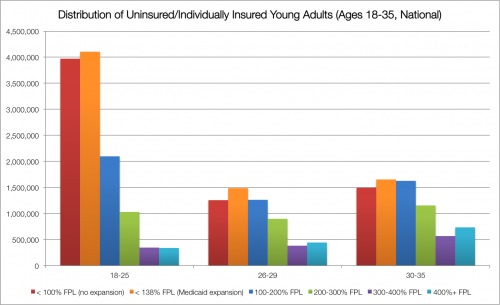

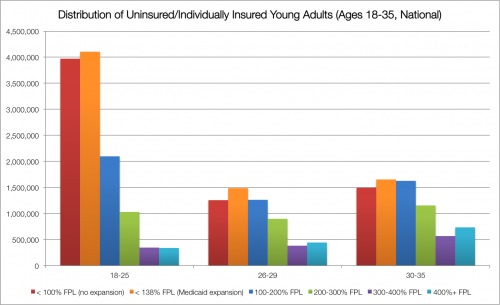

This chart comes courtesy of Adrianna McIntyre at Project Millennial and comes from census data. A good number of those – the young adults represented by the red and orange bars – aren’t eligible for the private insurance expansion. They either qualify for Medicaid, or live in a state that is not expanding the public program. “If we look at just the predicted marketplace target population — setting aside those who will receive coverage under the Medicaid expansion and those below the poverty line in nonexpansion states — we’re left with approximately 11 million adults between the ages of 18 and 35,” McIntyre writes. “The White House target is about a quarter of that.” One factor going in the administration’s favor here: There are significantly more young adults earning less than 200 percent of the poverty line than those earning above it. That means they will qualify for the more generous subsidies in the law, which would make purchasing health coverage a less significant financial commitment.

Florida, Texas and California are hugely important …

Far and away, they have the highest number of uninsured young adults, as you can see in this heat map created by the nonprofit Young Invincibles. They’re launching a campaign called Healthy Young America that will focus on signing these people up for insurance coverage. “A lot of our on-the-ground events will ramp up this fall,” President Aaron Smith says. “We think prior to October 1, we need to have a steady drumbeat of events on campuses. We’re targeting a lot of community colleges because they have high uninsured rates.” Smith expects that, at the end of the day, young adults’ decisions about whether to purchase coverage will come down to prices. “This can’t be some flashy media marketing campaign we’re running,” he says. “We’re not selling Coke. We’re selling a financial health-care product that people have to make a decision about.” He thinks that the rates will prove affordable enough to make a successful pitch. Smith points to California, where young adults can purchase coverage for $40 a month or less if they qualify for federal subsidies.  “I can’t tell you how important it is that I can tell a young person in California, a 22-year-old who makes $20,000, that they can buy a Silver plan for $50 a month,” Smith says. “Then it’s very concrete. All of a sudden it becomes very practical.”

“I can’t tell you how important it is that I can tell a young person in California, a 22-year-old who makes $20,000, that they can buy a Silver plan for $50 a month,” Smith says. “Then it’s very concrete. All of a sudden it becomes very practical.”

“I can’t tell you how important it is that I can tell a young person in California, a 22-year-old who makes $20,000, that they can buy a Silver plan for $50 a month,” Smith says. “Then it’s very concrete. All of a sudden it becomes very practical.”

“I can’t tell you how important it is that I can tell a young person in California, a 22-year-old who makes $20,000, that they can buy a Silver plan for $50 a month,” Smith says. “Then it’s very concrete. All of a sudden it becomes very practical.”

… but you can’t ignore the other states.

It’s possible that hundreds of thousands of young Californians will sign up for health benefits. That would likely drive down premium rates for other Californians, as young adults tend to have lower health-care costs. But that really doesn’t do much for the rates in neighboring Nevada – or any of the other 48 states, for that matter. Each state’s rates depend on who signs up in their market. This map shows the uninsured rate in each state. In a way, enrolling a young adult in South Dakota is more important than signing up someone in Texas. It’s a smaller market, meaning that one individual’s costs have a bigger influence on overall rates. On the flip-side, a spike in South Dakota rates would affect fewer people, so there’s a bit of trade-off in sorting out where to focus resources.

No comments:

Post a Comment