Excerpt: "California’s energy regulator recently rejected a planned open-cycle gas plant in favour of a solar PV facility on the basis of cost."

Solar PV – it’s cheaper than you think

By Giles Parkinson on 17 May 2012

Perhaps it’s time we should all stop kidding ourselves. So much of the political and economic debate around clean energy is framed through the idea that solar, in particular, is just too expensive, and will be for decades. But for the consumers who increasingly exercise the power of choice over the electricity they consume, this is just plain wrong.

The energy debate in Australia and overseas is framed around the wholesale cost of electricity – the price difference between cheap coal and new technologies such as solar, wind and geothermal. And even though coal and gas are unlikely to remain cheaper than solar or wind at utility scale in most markets beyond the end of the current decade, the point of choice is already made at the consumer level, where no one cares if it only costs Loy Yang A $2/MWh to produce electricity, they only worry about what’s on their bills. And at that level, solar on their rooftop is clearly a cheaper option.

This is one of the fundamental points made by a major new research paper released overnight byBloomberg New Energy Finance. It said that solar PV is much closer to price competitiveness with fossil fuel-generated electricity than many decision makers and investors realise, and policies have yet to catch up with the dramatic improvements in the economics of solar power, which has seen its cost drop 75 per cent in the last four years, and 45 per cent in the last 12 months alone.

“The perception persists that PV is prohibitively expensive, and still has not reached “competitiveness,” it says. But it notes that the wrong metrics are used to compare the costs of different energy sources. The idea of the term “grid parity” is confusing and used to compare wholesale prices with retail, misleading and confusing not just consumers, but decision makers too, with major implications on policies. More accurate to reflect the market dynamics, at least in the retail market, would be a term such as socket parity.

“The PV industry has seen unprecedented declines in module prices since the second half of 2008, the paper notes. “Yet, awareness of the current economics of solar power lags among many commentators, policy makers, energy users and even utilities.” It cites a bunch of reasons, including the very rapid pace of PV price reductions, the persistence of out-of-date data in information still being disseminated (occasionally by those with an interest in clouding the discussion), and the misconceptions and ambiguity surrounding many of the metrics and concepts commonly used in the PV industry.

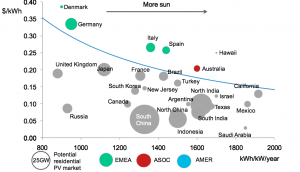

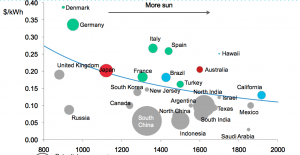

But before looking at that report in more detail, here are some graphs presented by one of the authors, Michael Liebreich, the CEO of BNEF, at the World Renewable Energy Forum in Denver overnight. Liebrich presented about a dozen graphs tacking the price parity of solar PV in key markets between 2010 and 2025. But here are the key ones – 2012, 2015, and 2025.

These graphs show the levellised cost of solar PV in the retail market, compared with the retail price of electricity, and ranks countries according to the amount of solar irradiation (right axis), size of PV market (circles). All countries above the blue line are at or better than price parity.

(The figures are based on 6 per cent cost of capital, 0.7 per cent a year module degradation, 1 per cent capex as O&M annually. $3.01/W capex assumed for 2012, $2.34 in 2015 $1.80/W in 2020 and $1.53/W in 2025.).

In 2010, only Hawaii was above the blue line, but in 2012, this is the situation, according to Liebriech.

This is what it will look like in 2015

…. in 2020 ….

and in 2025 ….

As you can see, Australian solar is already at parity, and will become an increasingly cheaper option – which means it is pretty much a no-brainer for retail consumers (who now have access to zero-down finance) and also for the commercial market, which pays higher tariffs. This is why commercial-scale rooftop PV is the hot new sector in Australia. Even US Energy Secretary Stephen Chu (according to my spies) made a point at the conference of noting that Australia was one of the first countries that have appeared above the line – it’s just a shame that Australia’s energy ministers (state and federal) don’t seem prepared to recognise this.

These arguments about parity have already been made by the International Energy Agency in their solar study last year, and more recently by McKinsey & Co, which made the point that solar PV is already competitive in four out of five key global energy market types, and by NRG CEO David Crane, who said this week that solar PV will do to electricity grids what mobiles did to fixed line telephony.

As the paper notes, changes to the economics of solar PV are happening so fast that it is hard to gain a coherent picture of the shifts occurring across the industry value chain around the world. But it does say that, despite efforts by the likes of Bjorn Lomborg and others to paint solar as “prohibitively expensive,” even on wholesale prices it is competing in some areas with coal and gas.

The US Department of Energy estimates the LCOE of PV at $0.10/kWh to $0.18/kWh for utility-scale, $0.16/kWh-$0.31/kWh for commercial systems and $0.16/kWh-$0.25/kWh for residential PV systems. Yet outdated numbers are still disseminated to governments and regulators (it might have made mention here of the Australian government’s appalling draft energy white paper, but didn’t).

It says the DOE is forecasting solar PV’s LCOE to $0.08-$0.10/kWh for residential, $0.06-$0.08/kWh for commercial and $0.05-$0.07/kWh for utility-scale solar PV. (That would make it cheaper than both coal and gas. Indeed, California’s energy regulator recently rejected a planned open-cycle gas plant in favour of a solar PV facility on the basis of cost).

The paper says “grid parity” is a curious and misleading term that applies to no other fuel source, except fuel cells. And it disguises the fact that many PV applications are not competing against wholesale generation but, instead, the delivered price of electricity through the grid.

Indeed, it even describes the graphs we published above as “busy‟ and “non-intuitive,” serving mainly to demonstrate how difficult a concept it is to communicate. “This places PV at a disadvantage at a time when the industry is seeking to send clear messages on competitiveness in its political communications and government affairs,” it notes.

*The paper, called, Re-Considering the Economics of Photovoltaic Power, was co-authored by representatives of UNSW, AGL Energy, the United Nations Industrial Development Organisation, Austria International Institute for Applied Systems Analysis, KMR Infrastructure, International Renewable Energy Agency, the Joint Institute for Strategic Energy Analysis, and Suntech Power.

#solar to join the conversation on Twitter

Share this:

Solar PV can stand on its own merits now, so no need for any new FIT. Solar PV is a much more powerful and persuasive argument when you can reduce the dependence on FIT.

Will we see defections to offgrid systems if the price of storage systems also reduce ?

I would like to know what subsidies relate to the overall picture.

Besides NSW is not all of Autsralia.

What subsidies, Australia wide, both gas and coal generation apply?

There are no papers addressing the facts,that I can find, so if anyone can enlighten me I would appreciate that.

What do we do on an ongoing basis to subsidise fossil fuels, coal and gas?Not talking about transport, another subject.

Do you think that once PV rooftop reaches full scale “socket” parity the price would really trend further downwards, or just remain slightly under the competitive price and increase profitabibility of the solar sector.

Also, assuming large scale storage is not developed, what do you think the net effect of the night time retail price. Given you still need the same MW capacity, would the wholsesale unit cost of this capacity increase due to reduced daytime capacity factor?

Regards

It is extremely unlikely that it will ever go ahead, as cost of production will be at least $24 a ton above the sale price. The NSW Government is broke.

I agree it does not make sense. Let them pay market rates for coal.

Even through my Uni Library I can count the number of academic studies on one hand. Most are from interest groups on both sides.

Cross subsidies to rural areas, the same.

Renewable Energy Target $356 million

Feed in Tariffs $96 million

Qld Gas Scheme $38 million

Greenhouse Gas Reduction Scheme $3 million

Total $494 to $694 million(low to high)

The subsidisation has nothing to do with coal and gas.