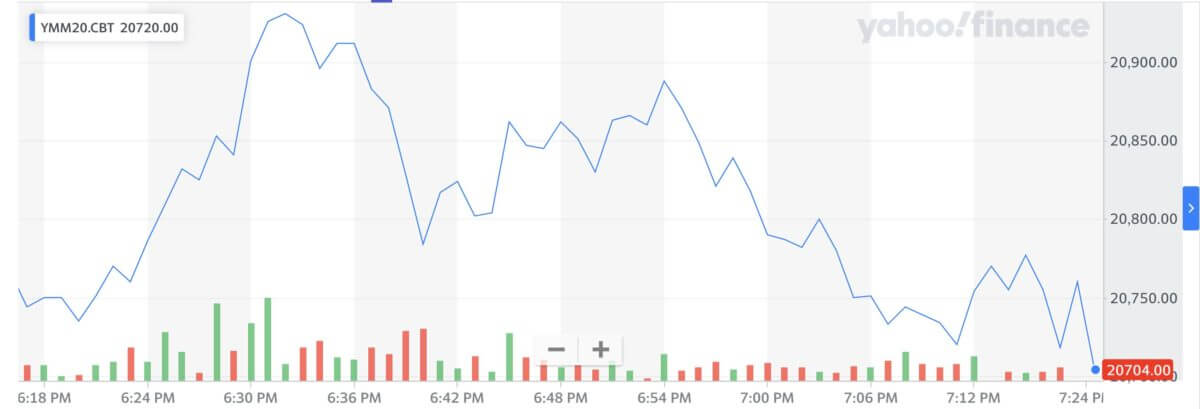

President Trump's massive stimulus proposal reinvigorated the bulls on Tuesday, but the gains quickly disappeared in after-market trading. | Image: Drew Angerer/Getty Images/AFPDow futures rallied after Donald Trump’s top economic adviser unveiled a massive $6 trillion stimulus package for the U.S. economy.

- These gains rapidly faded, as the stock market failed to move higher after a historic day for the Dow Jones on Tuesday.

- Worryingly for Wall Street, there doesn’t appear to be a Plan B if the fiscal package doesn’t push stocks higher longer-term.

After the largest single-day point rally in the history of the Dow Jones, the stock market failed to extend the move overnight despite a brief spike.

The volatility came after President Trump’s top economic adviser touted an incredible $6 trillion stimulus package for the United States.

Dow Futures Fall After Historic Rally

All three of the major U.S. stock futures indices popped and dropped Tuesday evening, after initially rallying in the wake of a multi-trillion-dollar stimulus announcement.

In the commodity sector, the price of oil ticked up 2.5% above $24 a barrel, while gold continued its impressive rally with another 1.5% gain.

Major cryptocurrency bitcoin has found its feet again, rallying 5% to around $6,800.

President Trump’s top economic adviser Larry Kudlow on Tuesday unveiled the biggest emergency spending package in history.

Providing direct aid to families, loan insurance for small business and bailouts for corporations, Kudlow announced the fund with the astonishing $6 trillion price-tag:

It’s a $2 trillion program and $4 trillion of lending power from the Fed. That’s a $6 trillion package. And by the way, the Fed can’t act fully unless we pass phase 2 because phase 2 contains the increase in the exchange stabilization fund, which is the equity piece for the Fed lending so that the U.S. government is the guarantor, not the Fed. So those two packages go together.

Economists Believe Fed Can Keep Bond Yields Down Despite Easing Program

While some are concerned about the inflationary impact of public spending of this scale, many analysts are anticipating that bond yields will remain subdued in the U.S.

ABN AMRO’s Bill Diviney anticipates that the Federal Reserve will be successful in capping yields, as policymakers wrestle to keep a historically strong U.S. dollar from getting out of hand:

Should large-scale asset purchases by themselves fail to bring yields down, or if the size of purchases become harder to sustain at some point, a viable option for the Fed might be to implement a formal cap on yields. One way or another, though – whether through market forces or central bank intervention – we expect bond yields to remain at these relatively low levels for at least the remainder of the year, regardless of the scale of fiscal stimulus.

When Trump eventually signs this package into law, the stock market will still have to deal with a plunging economy.

The proposed $3,000 for a family of four is not going to undo the damage of losing your job for too long, even if it provides some financial security to the most at-risk citizens.

Coronavirus Headwinds Are Not Going Away

Coronavirus cases continue to spread, as the U.S. now has more than 50,000 confirmed cases.

While the president is optimistic about opening up the economy as soon as Easter Sunday, ultimately it will be governors Newsom (California) and Cuomo (New York) who can lift the shelter-in-place orders.

Regardless of whether it works, the federal government is at least finally moving to support an economically paralyzed nation, and the positive impact could ripple through global markets as well.

The big problem for the Dow Jones will be if this rally does not follow through, as the Federal Reserve and government are both throwing everything they have at the stock market. There is not a plan B.

No comments:

Post a Comment