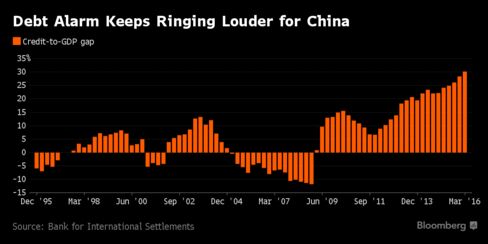

Warning Indicator for China Banking Stress Climbs to Record

- Credit-to-GDP ‘gap’ exceeds all other nations in BIS study

- China’s reading is its highest in data starting in 1995

Paul Panckhurst, Bloomberg

A warning indicator for banking stress rose to a record in China in the first quarter, underscoring risks to the nation and the world from a rapid build-up of Chinese corporate debt.

China’s credit-to-gross domestic product “gap” stood at 30.1 percent, the highest for the nation in data stretching back to 1995, according to the Basel-based Bank for International Settlements. Readings above 10 percent signal elevated risks of banking strains, according to the BIS, which released the latest data on Sunday.

The gap is the difference between the credit-to-GDP ratio and its long-term trend. A blow-out in the number can signal that credit growth is excessive and a financial bust may be looming.

Some analysts argue that China will need to recapitalise its banks in coming years because of bad loans that may be higher than the official numbers. At the same time, state control over the financial system and limited levels of overseas debt may mitigate against the risk of a banking crisis.

In a financial stability report published in June, China’s central bank said lenders would be able to maintain relatively high capital levels even if hit by severe shocks.

While the BIS says that credit-to-GDP gaps have exceeded 10 percent in the three years preceding most financial crises, China has remained above that threshold for most of the period since mid-2009, with no crisis so far.

In the first quarter, China’s gap exceeded the levels of 41 other nations and the euro area.

The data feed into debates about the outlook for the Chinese economy after a build-up in corporate leverage since the global financial crisis. The latest information was released by the BIS at the same time as its quarterly review.

No comments:

Post a Comment