Normal Interest Rates

Low Neutral Rates Blunt Central Banker Tools

By

| Sep 20, 2016

| Sep 20, 2016

When central banks started cutting interest rates to near zero after the 2008 stock market crash, they saw it as an emergency measure and thought things would gradually get back to normal. Now they’re wondering what normal means. Eight years later, the shadow of the Great Recession is keeping rates super-low, but even when it has passed, they’re unlikely to come all the way back. The reason is that the so-called normal or neutral rate of interest — which neither stimulates the economy nor cools it down — has fallen, perhaps permanently. If so, the implications for savers, investors and economic-policy makers will be far-reaching.

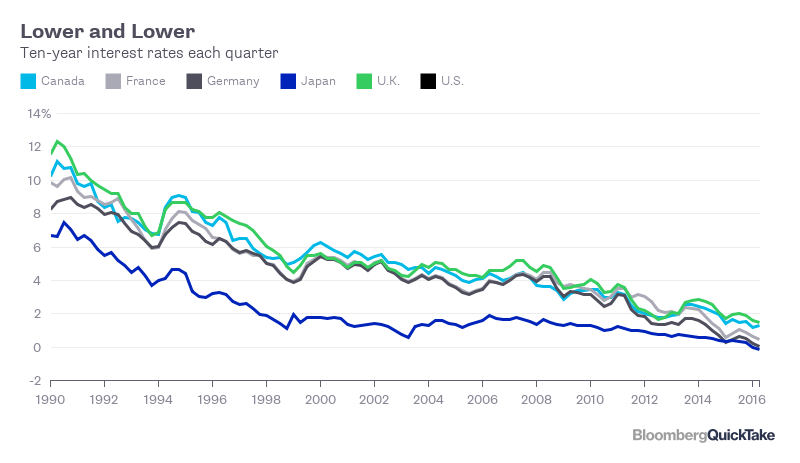

Average interest rates in 20 developed nations fell from about 5 percent in 1990 to near zero in 2015, a Bank of England study found. These low rates leave central banks little or no room to cut again if more stimulus is required. Some are already having problems. The U.S., Europe and Japan have tried a variety of tools to jumpstart economic growth, from quantitative easing (buying government bonds in exchange for new money on deposit at the central bank) to pushing interest rates below zero (negative rates). But these policies haven’t been as effective as central banks hoped. And the new fear is that this isn’t just a temporary problem. Why? The world has settled into a pattern of saving more and investing less. Instead of borrowing for expansion or new ventures, corporations are hoarding cash. This falling demand for capital has driven down the neutral rate of interest. And lower interest rates mean tiny returns, hurting investors saving for college and under-funded public and private pension systems struggling to keep up with payments to the swelling ranks of retirees.

The Background

Nations’ normal interest rates have historically tracked economic growth, which in turn is largely determined by productivity. In the U.S., the main index of productivity rose by almost 2 percent a year in the 50 years leading up to 1970; it’s grown by less than 1 percent a year since then. Many other countries have seen a similar slowdown. A narrowing gap between rich and poor countries (crimping opportunities for “catch-up” growth), smaller increases in the number of people getting a secondary education and fewer transformational inventions like air conditioning or computers add to the problem. Meanwhile, widening inequality within countries and a shrinking ratio of workers to dependents (mainly because of declining birth rates) have been pushing up savings. And the falling price of machines and other capital goods has kept spending on investment low. The resulting surplus of savings has acted to further lower interest rates.

The Argument

If productivity growth recovers, downward pressure on the neutral interest rate will ease. That’s possible. Some economists, like Erik Brynjolfsson andAndrew McAfee, argue that the full benefits of technologies such as artificial intelligence haven’t yet appeared. Others, like Tyler Cowen, insist that persistently slow growth, also called secular stagnation, is the new normal. But this slow growth and the lower normal rate of interest that goes with it don’t necessarily tie central banks’ hands. U.S. Federal Reserve Chair Janet Yellen has argued that there are tools that work, including quantitative easing and forward guidance (giving a clear direction to the markets, such as a promise to keep interest rates low for longer than investors expected). She says these levers can be used to support demand and keep unemployment low. Others disagree, arguing that more radical kinds of monetary innovation will be needed to encourage growth. These could include so-called helicopter money or deeply negative interest rates(which in turn might require the abolition of paper money to prevent hoarding). Almost all agree that fiscal policy — government spending or tax changes — ought to carry more of the burden of stabilizing economies.

The Reference Shelf

- This Bank of England paper on falling global interest rates serves as an excellent guide to other sources.

- The San Francisco Fed’s John Williams discusses monetary policy in the era of very low interest rates. In a more recent note, he asks whether ahigher inflation target would help.

- Ken Rogoff’s 2016 book, “The Curse of Cash,” explains how abolishing paper money would make it possible to push interest rates as negative as necessary.

- Former U.S. Treasury Secretary Lawrence Summers and Brad DeLong wrote on the role that fiscal policy ought to play.

- Robert Gordon has written the book on the growth slowdown. Summers lays out the case for secular stagnation, and Ben Bernanke, the former Federal Reserve chairman, pushes back. A QuickTake on the subject.

FIRST PUBLISHED SEPT. 20, 2016

No comments:

Post a Comment